The week ahead 08/08/2022

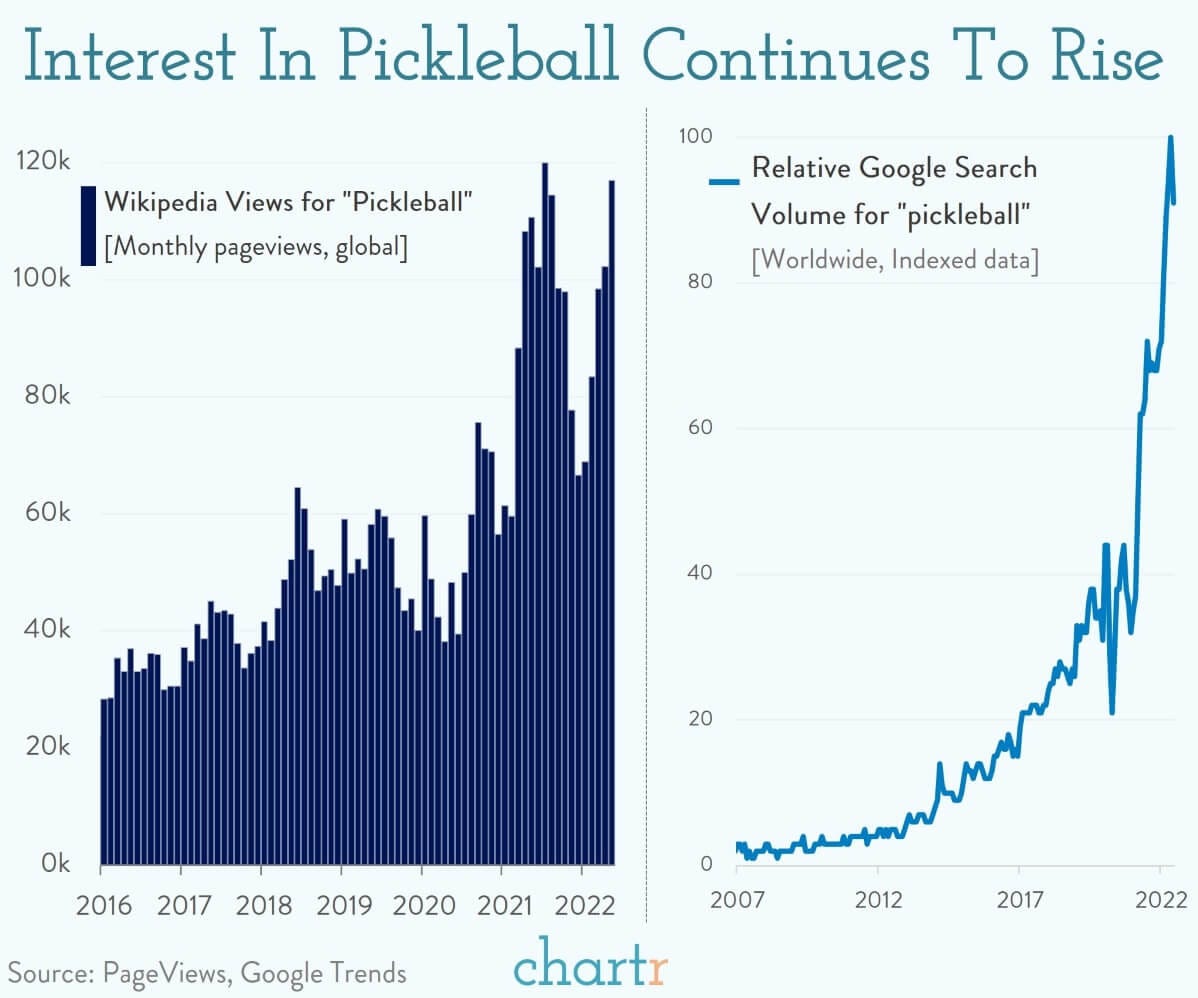

Happy National Pickleball Day.

Sometimes these intros are more focused on the macro market environment, such as yesterday’s Week in Review excerpt on the inverted yield curve. Today… we need to call out the hottest sport in the country.

We also didn’t realize that Major League Pickleball (MLP) took over the New York Stock Exchange (NYSE) in May — ringing the opening bell!

Naturally, we thought about how this space could be investable. We’re not necessarily sprinting to the ‘buy’ button on pickleball plays during a recession, but below are some cool callouts:

Pickleball is the fastest growing sport in America.

Pickleball boasted 4.8 million players last year in the U.S., a participation growth rate of 39.3% since 2019.

Marc Lasry (Milwaukee Bucks Owner), Gary Vaynerchuk (Chairman of Vayner Media) and Tom Dundon (Carolina Hurricanes Owner) have recently made sizable investments in the sport.

Leading paddle-maker Selkirk inked a deal with Costco (COST -0.29%↓) to sell pickleball paddles across the country.

Retailers like Skechers (SKX -0.53%↓) are signing players to rep their brands.

Major broadcast networks like CBS, Fox Sports and the Tennis Channel now air pickleball matches.

Billionaires like Melinda Gates and celebrities like Ellen DeGeneres, Leonardo DiCaprio and the Kardashians all call themselves pickleball players.

Danger Close?

One other quick callout is that BlackRock CEO Larry Fink recently sold ~8% of his own stock. This is the largest stock sale he’s made since before the Covid crash. As many have said before, “BlackRock knows all and sees all…”

The Investing Week Ahead — Too Long, Didn’t Read:

⚡ Coinbase, Disney, Dutch Bros, Palantir, Roblox, & more report as we crawl toward the end of this earnings season.

⚡ Ethereum is in focus for the entire crypto space.

⚡ Prices for consumers, prices for producers, and overall sentiment will be updated.

Key Earnings Announcements:

Buffett encourages investors to overlook short-term investment losses, Celsius Energy Drinks reached the mountaintop, and Coinbase will dive deeper into its BlackRock relationship.

Monday (8/8): Barrick, Berkshire Hathaway, BioNTech, Blink, Digital Ocean, Dominion Energy, Lemonade, Luminar, Monday.com, Novavax, Palantir, Tyson, Upstart

Tuesday (8/9): Celsius Holdings, Coinbase, Hilton, Norwegian Cruise Line, Planet Fitness, Ralph Lauren, Roblox, Spirit Airlines, Sysco, The Trade Desk, Unity, Wish, Workhorse, Wynn Resorts

Wednesday (8/10): Bumble, Coupang, Disney, Dutch Bros, Fox, Jack in the Box, Marqeta, Paysafe, Sonos, Wendy’s, Wix

Thursday (8/11): Canada Goose, Illumina, Rivian, Six Flags, Vermillion Energy, Veru

Friday (8/12): ProPhase Labs, Spectrum Brands

What We’re Watching:

Grandpa Buffett: In its classic “we do things our own way” style, Berkshire Hathaway released its earnings info over the weekend. Operating earnings came in at $9.3 billion in the Q2’22 — notching a +39% increase year-over-year. However, Berkshire posted a -$53 billion loss on investments during the quarter. Despite the losses, Buffett apparently still loves his oil play.

“The “Oracle of Omaha” has been steadily adding to his Occidental Petroleum (OXY 1.17%↑) stake since March, giving Berkshire a 19.4% Occidental stake worth about $10.9 billion.” — CNBC

Celsius Energy Drinks “Made It”: Last week, the WSJ reported that PepsiCo (PEP -0.41%↓) will pay $550 million for an 8.5% stake in the “healthy” energy drink company — Celsius Holdings. Back in 2020, Pepsi paid nearly $4 billion to buy Rockstar Energy — while this deal valued Celsius at nearly $6.5 billion. The company posted over $314 million of revenue in 2021, a +140% increase from the year before. Shares of Celsius (CELH 4.14%↑) are up +33% over the last month and the company now holds a market cap of nearly $7.5 billion. We’re excited to hear more details on the investment from Pepsi during this (likely overvalued) company’s earnings report on Tuesday.

It Takes Two to Tango:

The country’s most well-known crypto company has teamed up with the world’s largest asset manager, BlackRock (BLK 1.37%↑) . In what’s been a tumultuous year for Coinbase (COIN 1.01%↑), shares of the crypto exchange have risen +40% over the last five trading days from the news. Top BlackRock clients will be able to use its Aladdin investment-management system to oversee their exposure to Bitcoin along with other portfolio assets such as stocks and bonds, and to facilitate financing and trading on Coinbase’s exchange. BlackRock says the partnership focus “will initially be on Bitcoin.” Coinbase is expected to give further insight into the partnership on Tuesday.

Investor Events:

Crypto folks hope ETH doesn’t disappoint, Coke vs. Pepsi, and conferences featuring dozens of S&P 500 companies.

-

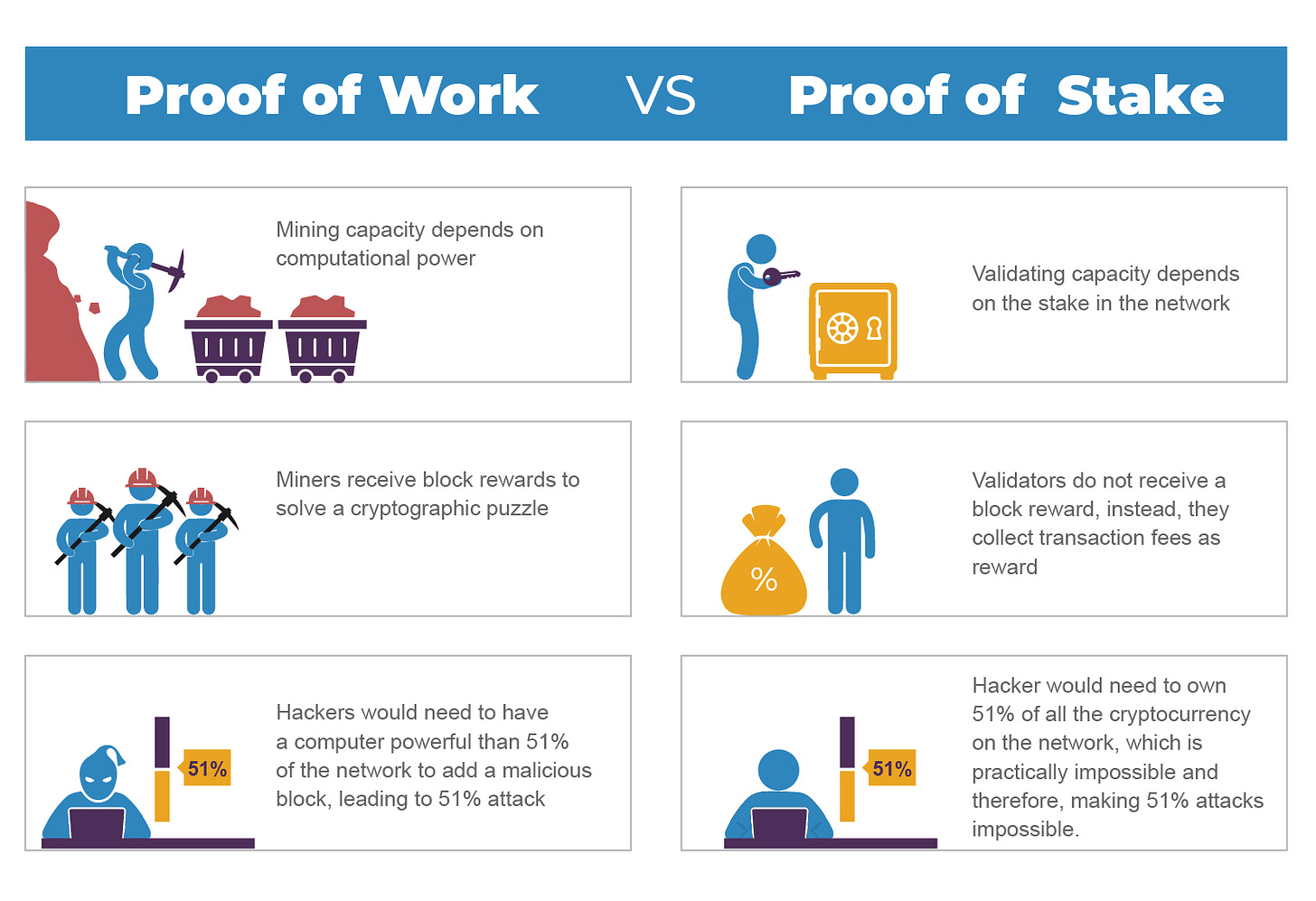

Ethereum’s Transition to Proof-of-Work: On the same vein as the Coinbase notes above, crypto bulls are watching closely to see how Ethereum’s final merge test this week performs before transitioning to a proof-of-stake protocol. Digital asset providers of all kinds are hoping that the final “dress rehearsal” — called “Goerli” — goes smoothly for the Ethereum network.

-

Nielsen Retail Data: We’ll be eyeing how packaged goods such as generic beverages, beer, and spirits have performed over the last month. There’s currently uncertainty surrounding who has been gaining or losing market share among Coca-Cola (KO -0.03%↓), Constellation Brands (STZ -1.47%↓), Keurig Dr. Pepper (KDP 0.10%↑) , and PepsiCo (PEP -0.41%↓).

-

Conferences: BofA Securities 2022 SMID Cap Ideas Conference, Jefferies 2022 Industrials Conference JP Morgan Auto Conference, Oppenheimer 25th Annual Technology Internet & Communications Conference, UBS Financial Services Conference

Major Economic Updates:

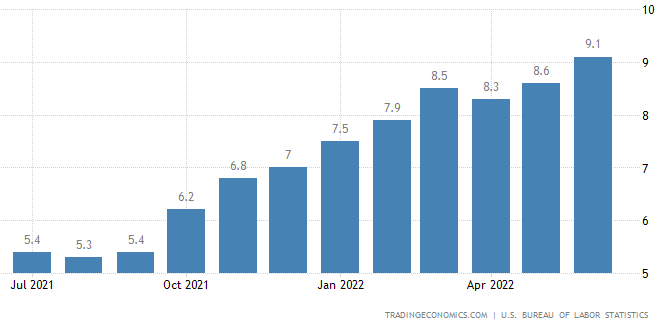

That beautiful time of the month again — inflation for consumers, inflation for producers, University of Michigan’s sentiment reading, and more.

Monday (8/8): NY Fed 3-Year Inflation Expectations

Tuesday (8/9): NFIB Small Business Index

Wednesday (8/10): Consumer Price Index (Inflation), Federal Budget

Thursday (8/11): Producer Price Index

Friday (8/12): Import Price Index, House of Representatives Vote on “Inflation Reduction Act”, UMich Consumer Sentiment Index

Understanding Headline Inflation vs Core Inflation: The difference between the inflation numbers we see in the news and ‘core’ inflation is that food & energy are included in the headlines. These are more volatile to price changes than pretty much any other good or service, so the core inflation is often considered a better gauge for the true direction of inflation as a whole — not just a month-to-month stance. Regardless of if headline inflation appears to be slowing (given recent gas price decreases), we’d still expect significant Fed rate hikes if the core inflation comes in with the increase expected.

“Core inflation is something we think about because it is a better predictor of future inflation, but headline inflation is what people experience. They don’t know what core is. Why would they?” — Chair Fed Jerome Powell

Expected Headline CPI Increase: +8.7%

Expected Core CPI Increase: +6.1%

Events Driven Winners:

What specific events are moving stocks the most?

Our friends at LevelFields scrub through thousands of data points each week to determine how events impact stock prices.

What an insane week of events-driven moves:

iRobot got the greatest gift of all time — an all-cash acquisition bid from Amazon.

MicroStrategy CEO Michael Saylor — otherwise known as ‘that crazy bitcoin guy’ — has stepped down as CEO. He will act as executive chairman & chairman of the board of directors. The stock rose on the news of pushing the company in a new direction, but ultimately this is still a company that saw revenue from its core operating software business decline -3% YoY.

Robinhood is cutting ~23% of its full-time staff, after making a ~9% slash just back in April. The two rounds of layoffs have reduced the Robinhood employee-base by more than 1,000 jobs. It’s a sad, yet reasonable, reality that these layoffs almost always increase stock prices.

If you’re starting your investing journey or want to change to a cleaner, social-focused investing platform, consider visiting Public.com.

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.