The week ahead 04/11/2022

Happy Monday!

Do me a favor and request to join our Rate of Return LinkedIn group 🙂

With Easter Weekend on the way, things slow down a bit in the markets. However, we’ve officially entered the Q1 earnings cycle with popular banks like Citigroup, Goldman Sachs, and Wells Fargo leading the charge.

Two Quick Callouts:

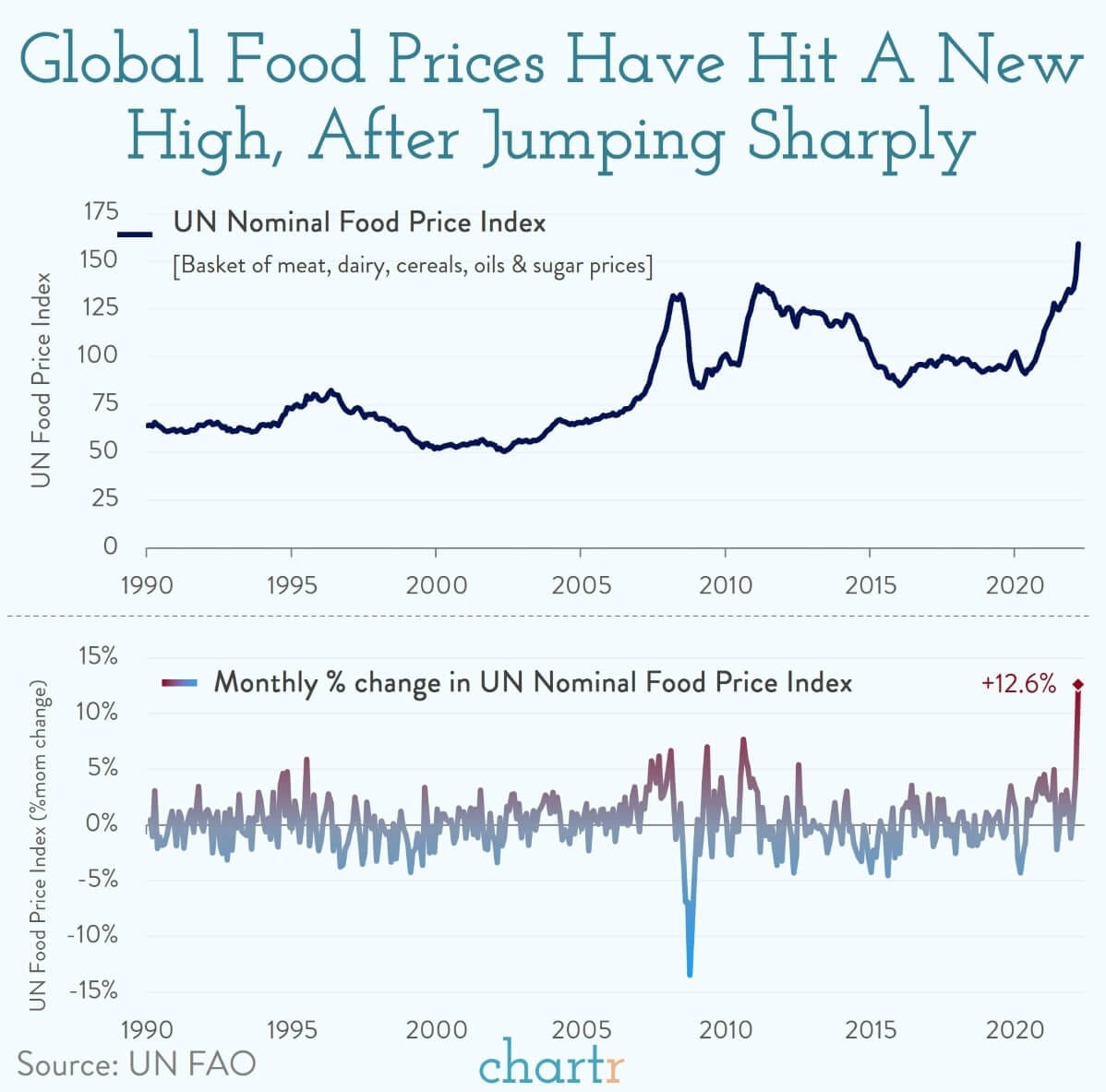

1) It’s important to be forward-looking investors, despite the short week (market closed for Good Friday). The stock market typically stagnates as the summer approaches (“sell in May and go away”). Food prices also seem to be climbing higher — another negative headline fighting against the markets.

Keeping tabs on our capital allocation has become increasingly important. I’ll be sharing my complete watchlist (including their valuations) later this week!

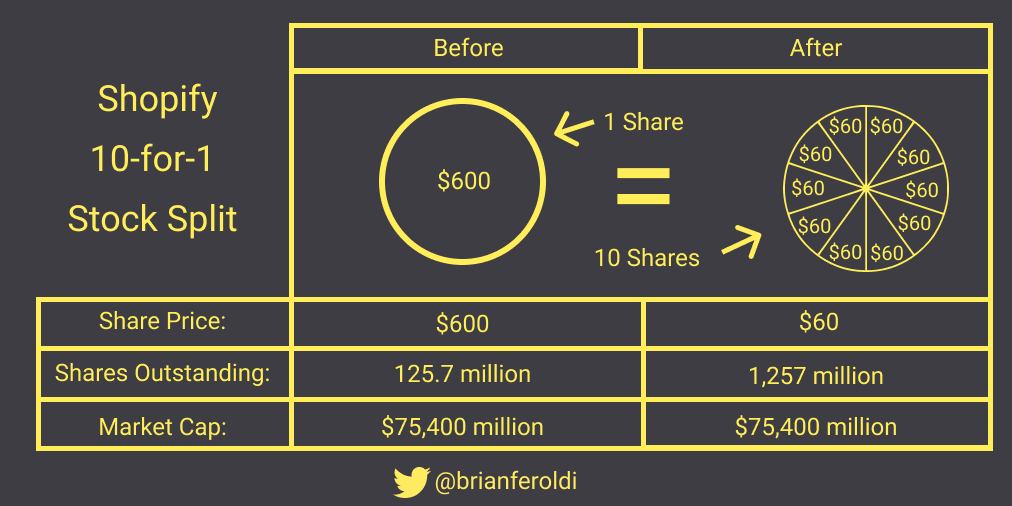

2) On another note, Shopify (SHOP) just announced a 10-for-1 stock split this morning — joining Alphabet, Amazon, and Tesla in the recent pattern.

Below is a great illustration explaining the split!

Let’s jump into everything that should be on your radar!

In This Post:

-

Quarterly financial reports worth reading

-

Investor events to keep an eye on

-

Major economic releases

-

Event-driven winners

Consider using Seeking Alpha to conduct your research along the way.

The Investing Week Ahead – Too Long, Didn’t Read:

Elon Musk isn’t joining Twitter’s Board anymore, but he is hosting a TED Talk this Thursday. Inflation readings are expected to come in around +8.4%, which might be a topic of discussion for the bank stocks reporting their earnings this week.

Key Earnings Announcements:

Financials lead the way.

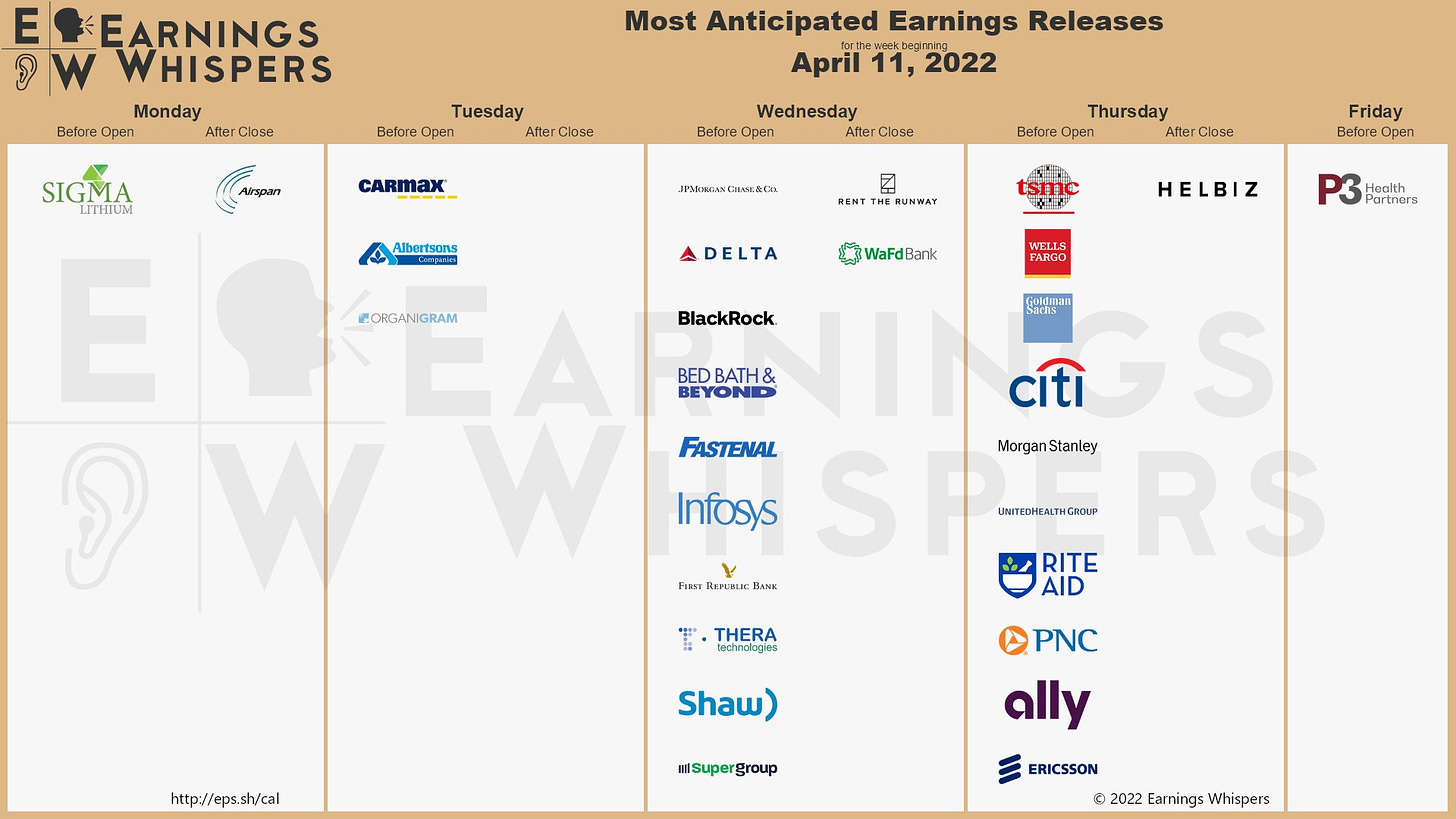

Tuesday (4/12): Albertsons, CarMax

Wednesday (4/13): Bed Bath & Beyond, BlackRock, Delta, JPMorgan Chase, Rent the Runway

Thursday (4/14): Ally, Citi, Ericsson, Goldman Sachs, Morgan Stanley, PNC, Rite Aid, TSMC, UnitedHealth Group, Wells Fargo

Friday (4/15): P3 Health Partners

What we’re watching:

1. UnitedHealth Group (UNH) reports their earnings this Thursday — as you all know, UNH is one of my largest holdings and has been on an absolute rampage YTD (up +15% against the market). However, I think UNH might now be leaning more on the “overvalued” side of the aisle — which means high expectations as we head into the release. Proceed with caution.

2. Fund flows — as of this past Friday, U.S. investors discarded value funds worth $2.35 billion in a third straight week of net selling — while growth funds posted inflows of $348 million after a week of net selling.

Among U.S. sector funds, investors offloaded financial funds worth $3.47 billion — marking the biggest outflow since at least May 2020.

U.S. consumer discretionary, industrials and tech funds lost $724 million, $575 million and $262 million respectively in outflows — while metals & mining funds gained $211 million in net buying.

UBS noted that there could be surprise beats across the financials sector, with the benefits of higher rates and better-than-expected loan growth being catalysts. They fight to overshadow negative forces like weakened equity markets and rising expenses in labor, tech, & acquisition.

Investor Events:

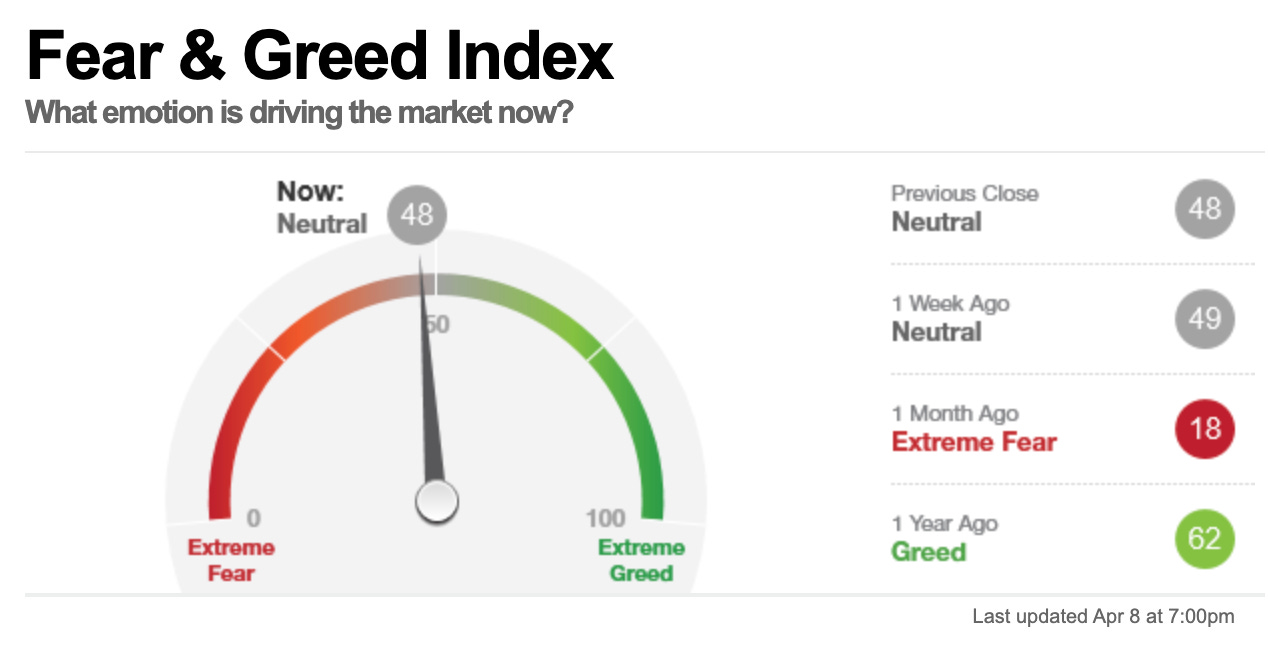

All eyes still remain on Elon Musk — Twitter drama, a TED Talk, and the spotlight on Tesla’s new production capabilities after opening gigafactories in Austin and Berlin. These theatrics take place as investors are torn on conviction of market strength.

Tuesday (4/12): ARK Invest Monthly Webinar

Wednesday (4/13): Ford CEO discusses the Ford+ Plan w/ Bank of America

Thursday (4/14): Adobe Annual Meeting, Elon Musk TED Talk

Friday (4/15): Stock Market Closed for Good Friday

All Week:

-

Jefferies Virtual Space Summit

-

Needham Healthcare Conference

-

Wells Fargo Biotech Forum

-

Cantor US Cannabis Conference

Twitter was set to host a Q&A between its newest board member, Elon Musk, and the employees of the company. As of late Sunday evening, Musk is no longer going to join the board of the company.

Here is the announcement from Twitter’s CEO. There is likely to more to come from this story throughout the week. Let the speculation begin!

Major Economic Updates:

Updates on consumer & producer prices (inflation), retail sales, and overall consumer sentiment.

Tuesday (4/12): Consumer Price Index, Federal Budget Deficit

Wednesday (4/13): Producer Price Index (Final Demand)

Thursday (4/14): Consumer Sentiment, Retail Sales

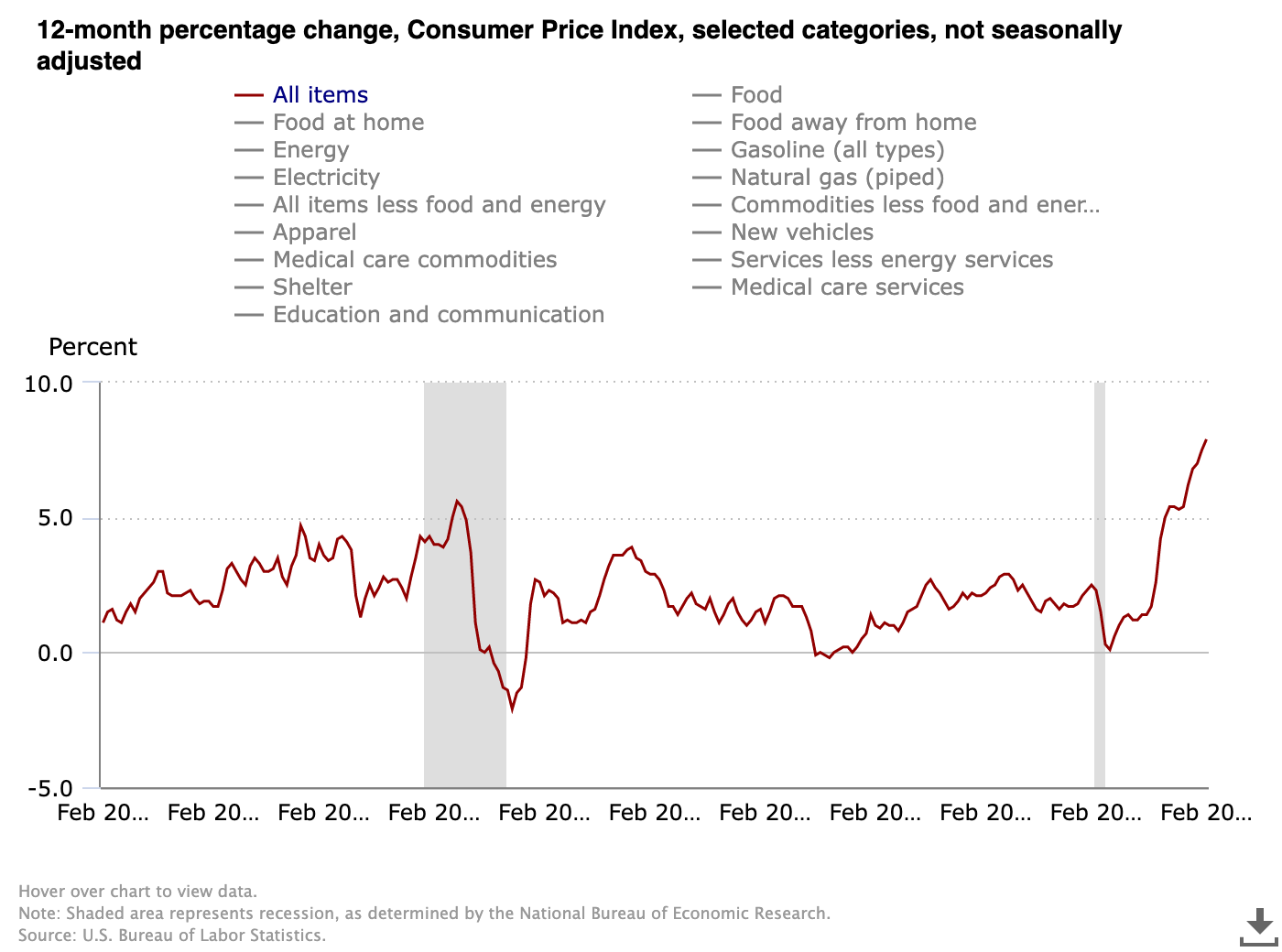

This month’s CPI reading is expected to show inflation rising +1.1% in March on a month-to-month basis and +8.4% on a year-over-year basis.

This would be an acceleration from the previous January-to-February inflation spike — causing economists to wonder how close we are to true hyperinflation. For fun, these folks pulled together “censorship-resistant” inflation data — their data measures a +13.3% inflation rate vs. the +7.9% rate we’ve been told by our government.

Events-Driven Winners:

What specific events are moving stocks the most?

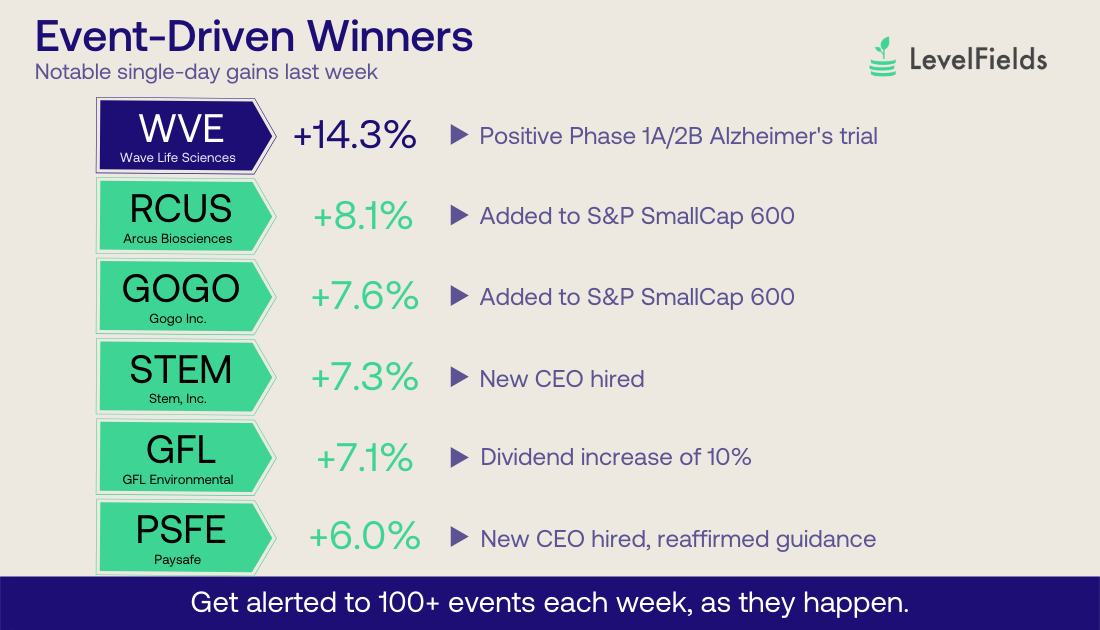

Our friends at LevelFields took the time to scrub through thousands of data points and determine how events impacted stock prices last week.

They also just created a popular “Added to S&P SmallCap 600” tracker. It’s a good example of how watching the events can not only bring some quick one-day gains but also put up-and-coming companies on your watchlist.

If you find these Week Ahead posts helpful, please consider sharing with a friend! Have a great start to your week!

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.