The week ahead 03/28/2022

Welcome back to another week of navigating the wild world of investing!

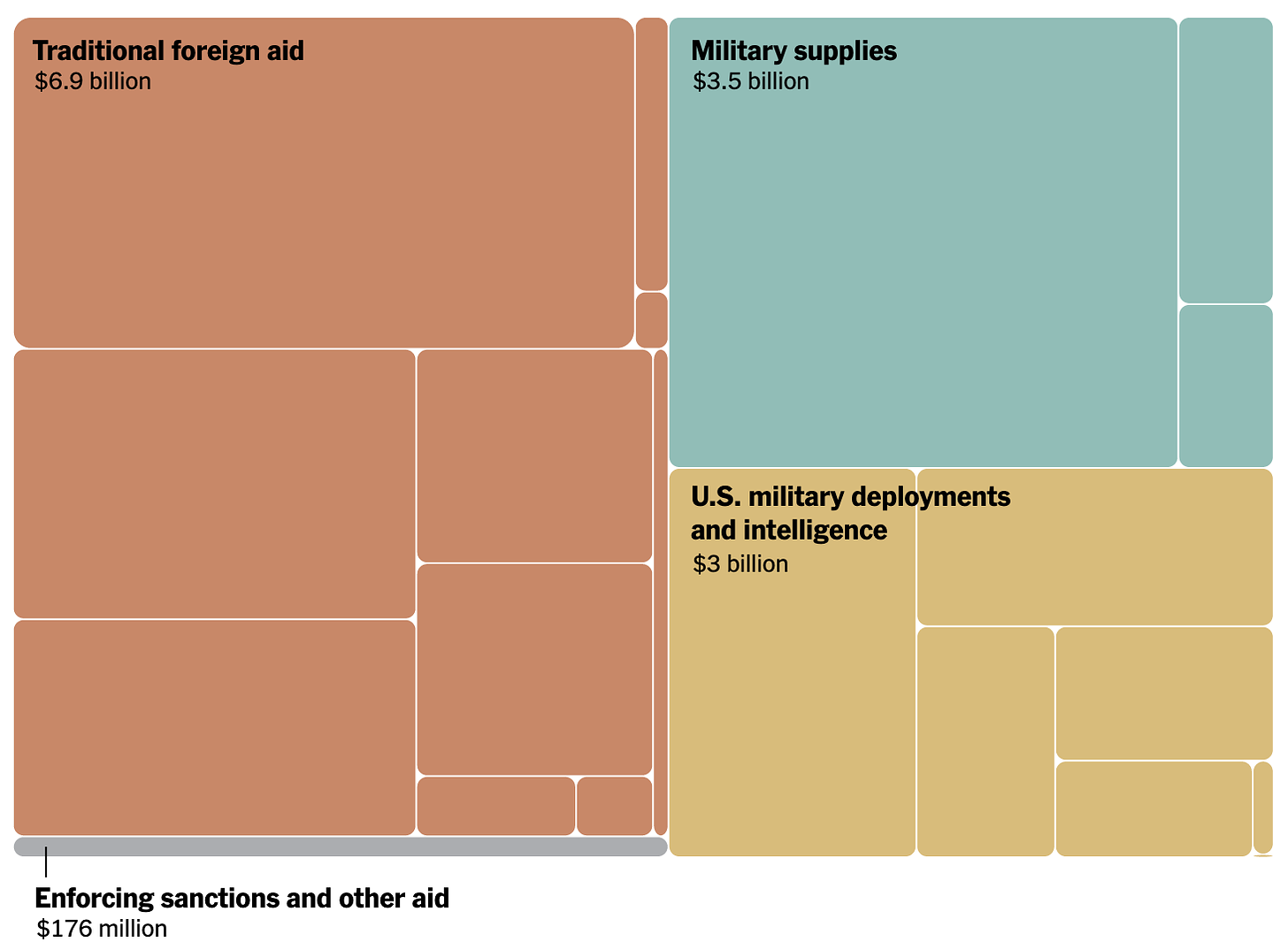

Before we begin, I thought this was an interesting graphic from the New York Times. It visualizes the current US spend on the Ukraine situation — showing just how expensive our international involvements can be.

Let’s jump into everything you should know — from earnings reports & stock-moving events to investor days & economic updates.

In this post, we’ll cover:

-

Quarterly financial reports worth reading

-

Investor events to keep an eye on

-

Major economic releases

-

Event-driven winners

Consider using Seeking Alpha to conduct your research along the way.

The Investing Week Ahead – Too Long, Didn’t Read:

-

Earnings reports from Micron, Lululemon, Jefferies, Chewy, Restoration Hardware, Walgreens, and UiPath

-

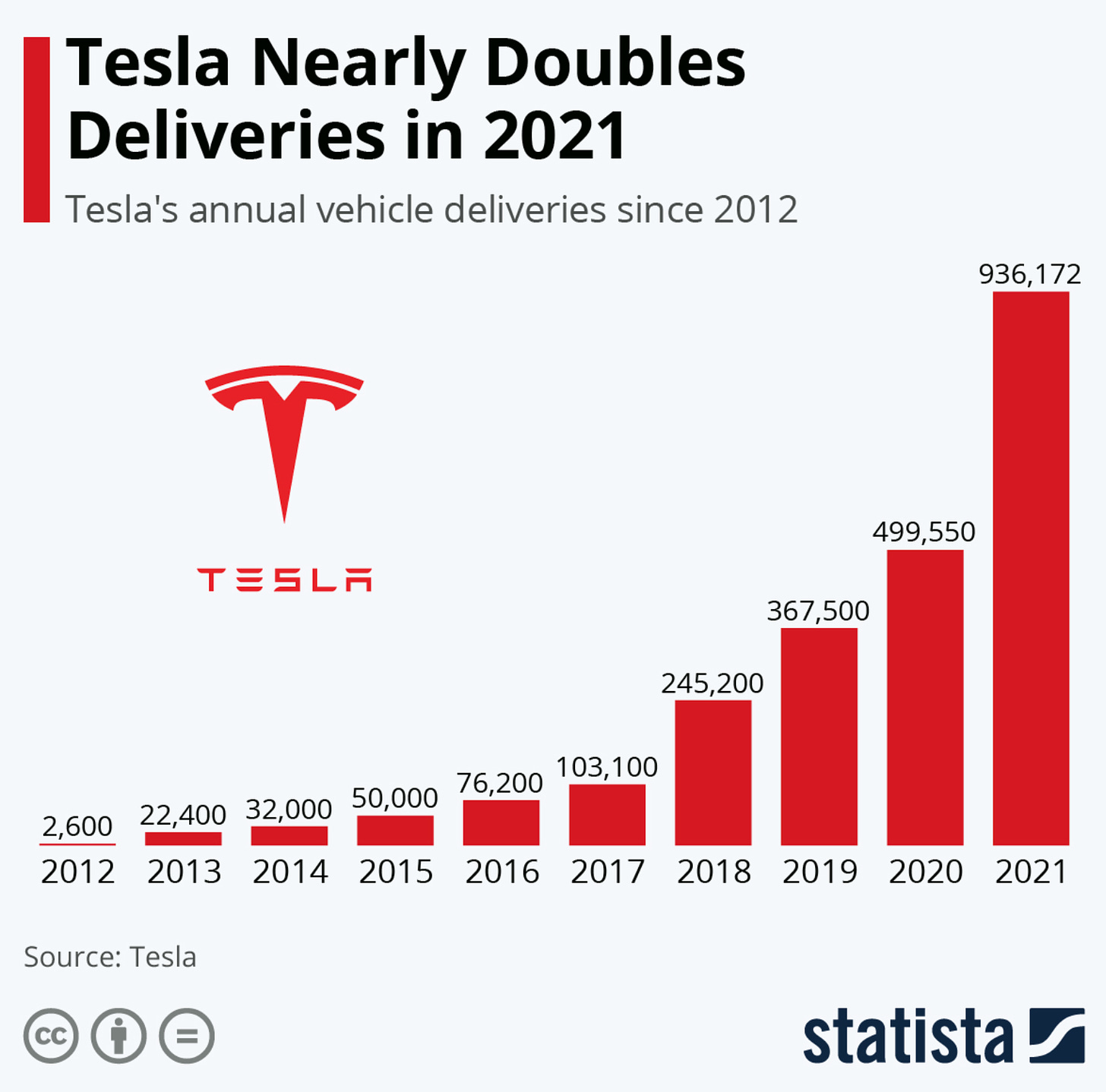

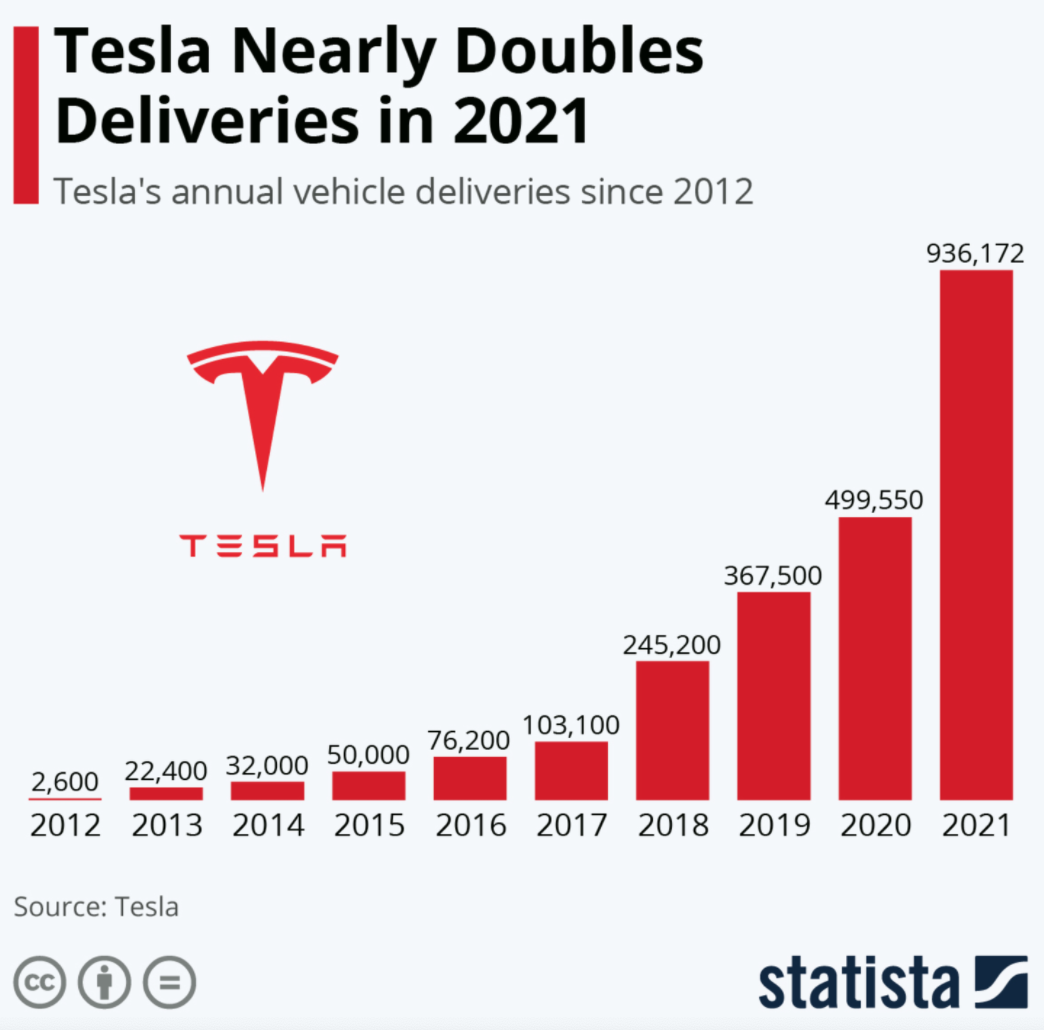

A slew of electric vehicle delivery reports show us the current state of the industry

-

US labor market and GDP updates help paint a better picture of the economy’s health

Key Earnings Announcements:

A diverse set of financial reports comes in as we head into the typically-green month of April.

Monday (3/28): Dave & Buster’s, Jefferies, XPeng

Tuesday (3/29): Chewy, Lululemon, McCormick & Co, Micron Technology, Restoration Hardware

Wednesday (3/30): Arhaus, BioNTech, Five Below, Paychex, UiPath

Thursday (3/31): Blackberry, Blend Labs, Walgreens

Where we’re looking:

Micron Technology (MU) — Analysts have mixed feelings for the company’s past quarter, but generally high expectations on guidance. The $87B+, Boise, Idaho-based chipmaker is expected to be a bellwether for other tech stocks reporting earnings over the coming weeks.

Lululemon (LULU) — As mentioned in yesterday’s Week in Review, I’m planning to open a small position in Nike (NKE) after a solid earnings report. I already have 1% of my total portfolio in Lululemon, but will be keeping an eye on supply chain issues / physical store performance to determine if I should make any moves on this holding.

Arhaus (ARHS) & Restoration Hardware (RH) — Both Arhaus and RH have solidified their leadership positions in the high-end home décor market. We’ll be focusing on how each companies’ management teams are going to ensure long-term profitability. RH has also launched numerous high-end restaurants / wine bar locations in their already-existing stores — I’m interested in learning more about how this impacts their bottom line.

UiPath (PATH) — Since the companies IPO nearly a year ago, UiPath has been in a downward spiral. However, big banks like Wells Fargo still view the company as a top automation software pick. I have many peers who use UiPath’s robotic process automation in their day-to-day work — let’s see if this is the earnings call that finally turns things around for the NYC-based platform.

Investor Events:

Our ‘spring break’ for investor events is currently underway, with the main focus being on electric vehicle development.

Tuesday (3/29): Gildan (GIL) Investor Day

Wednesday (3/30): Five Below (FIVE) Inaugural Investor Day

Throughout the Week: EV Deliveries Updates (TSLA, NIO, LI, XPEV)

Bank Conferences: Maxim Growth Conference, Bank of America Virtual Crypto Mining Conference, Bank of America ESG Consumer & Retail Conference, Jefferies Pan-European Mid-Cap Conference

Given the relatively light slate of earnings, I’ll be paying close attention to the electric vehicle deliveries reported this week. Paying subscribers may have seen that I added to my Tesla position last week.

Major Economic Updates:

Important econ reports are back in the spotlight this week, with a focus on the current state of the labor market and revisions to the US GDP.

Tuesday (3/29): Job Openings & Quits

Wednesday (3/30): ADP Employment Report, Final GDP Values for Q4 and 2021

Thursday (3/31): PCE Price Index

Friday (4/1): Jobs Report & Unemployment Rate, Construction Spending, ISM Manufacturing Index

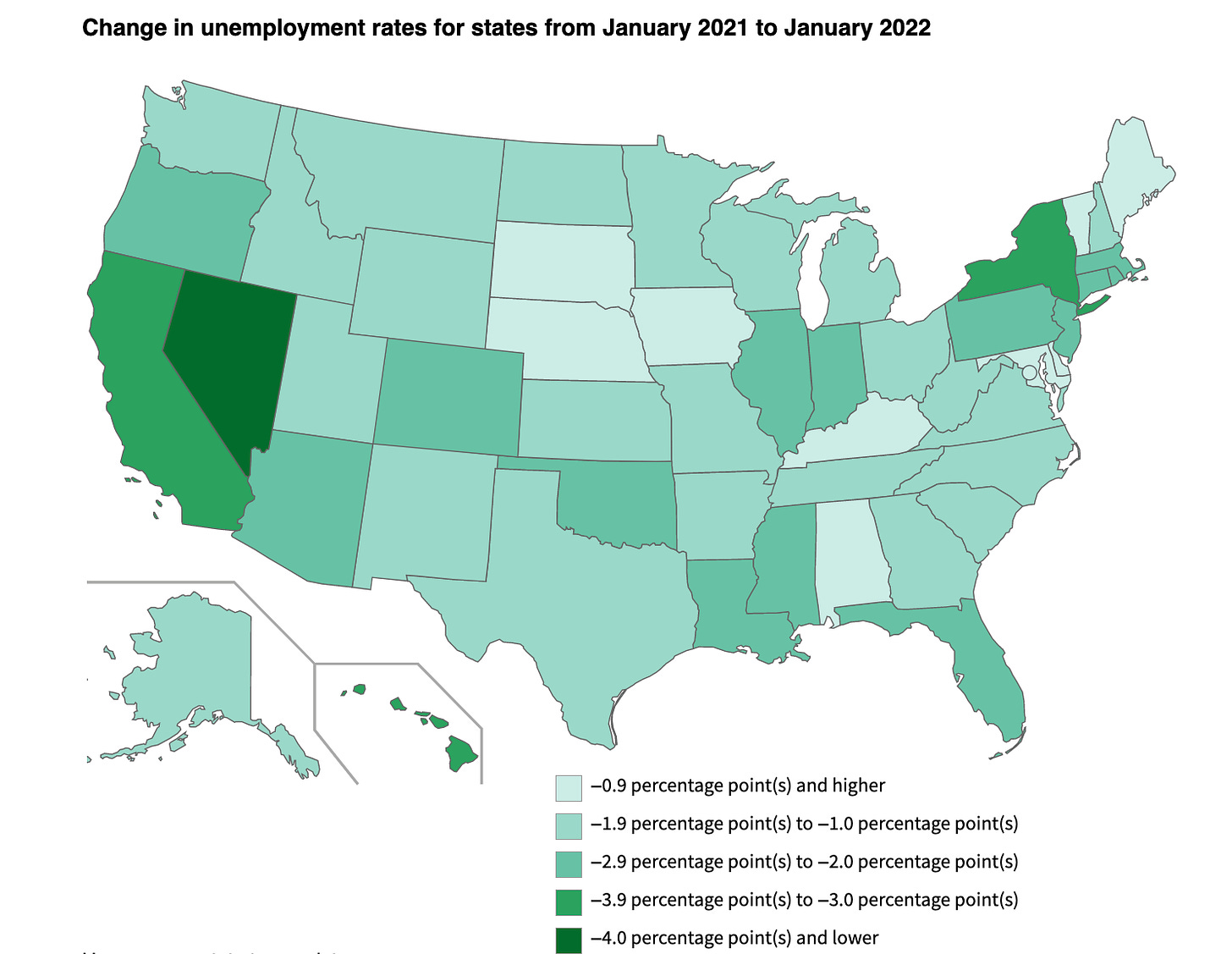

As mentioned in yesterday’s Week in Review, initial jobless claims hit their lowest level since 1969 — as demand for workers is much higher than supply and companies are doing everything possible to retain employees.

With negative international relations, inflation concerns, and even food shortage projections — the broader market is clinging to these positive labor market trends.

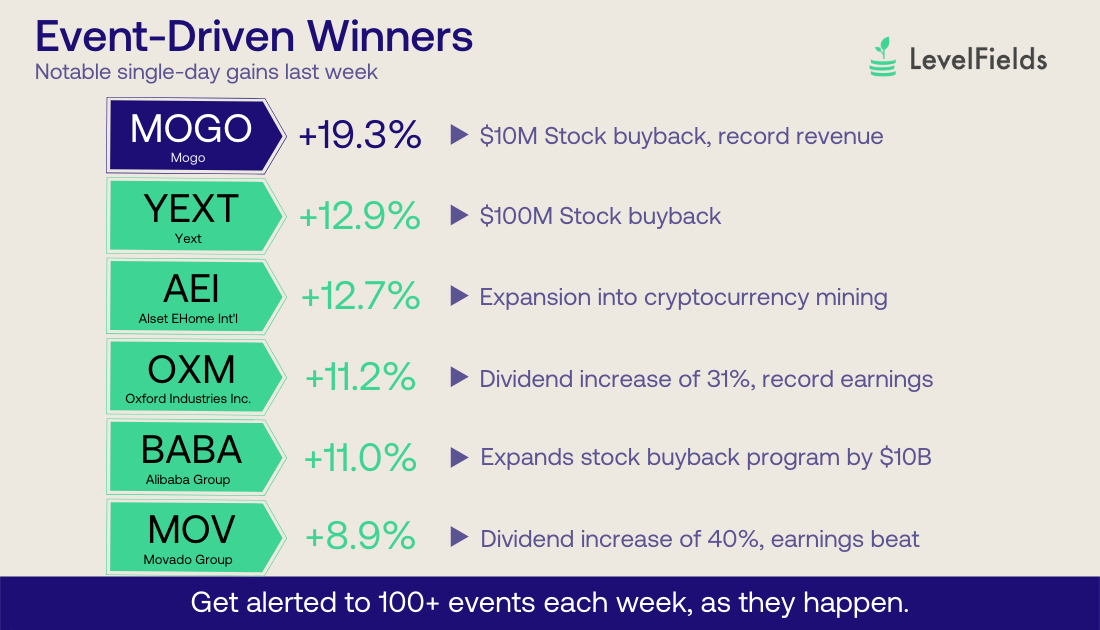

Events-Driven Winners:

What specific events are moving stocks the most?

Our friends at LevelFields took the time to scrub through thousands of data points and determine how events impacted stock prices last week. It’s a great platform for catching trading opportunities as they arise.

If you find these Week Ahead posts helpful, please consider sharing with a friend! Have a great start to your week!

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.