The week ahead 03/21/2022

Spring is Here!

Hoping you had a better weekend than I did after watching my Tennessee Vols get upset in March Madness! :/

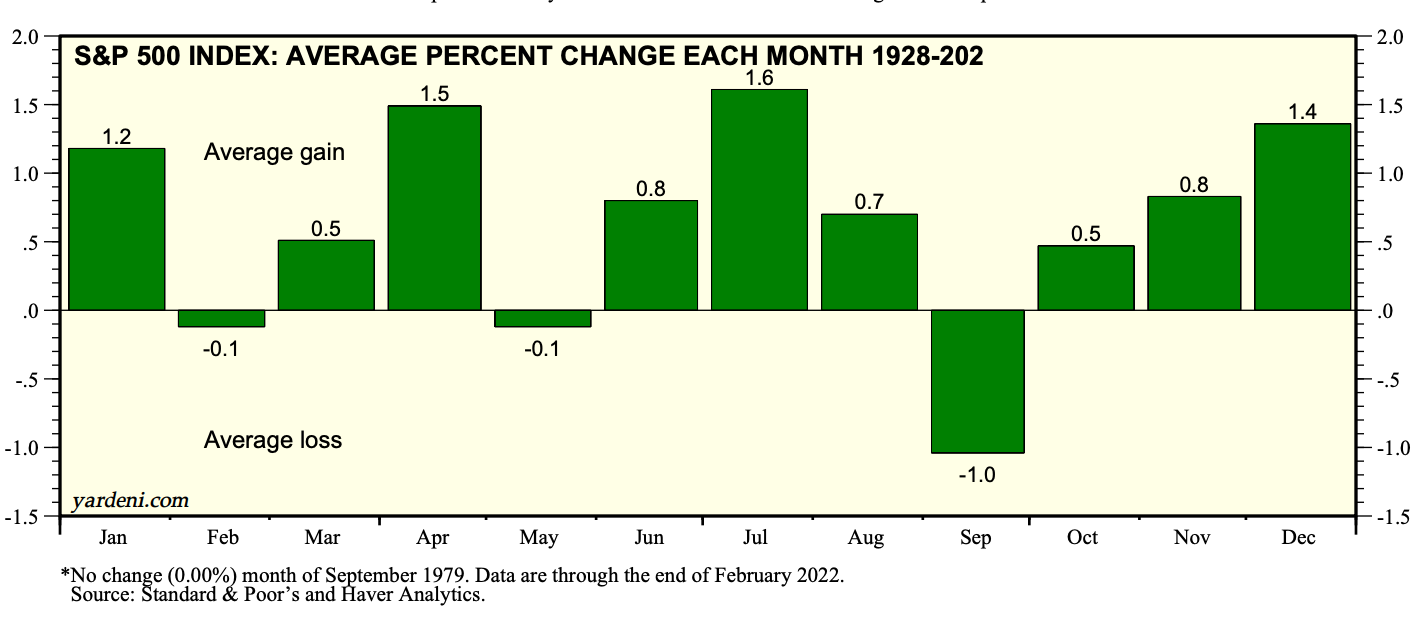

Fun Fact: Since 1928, the beginning of spring has historically been one of the best times in the stock market — with April having the second-highest average % gain of any month. Perhaps everyone just gets happier with the springtime?

Do I still believe we’re in a bear market? Absolutely — there’s a lot of negative forces pushing against us. However, a multi-week relief bounce could be taking place.

In this post, we’ll cover:

-

Quarterly financial reports worth reading

-

Investor events to keep an eye on

-

Major economic releases

-

Event-driven winners

Consider using Seeking Alpha to conduct your research along the way.

The Investing Week Ahead – Too Long, Didn’t Read:

-

Earnings reports from Nike, Adobe, BuzzFeed, Clear Secure, Darden Restaurants, & Nio

-

Nvidia hosts one of year’s most anticipated conferences

-

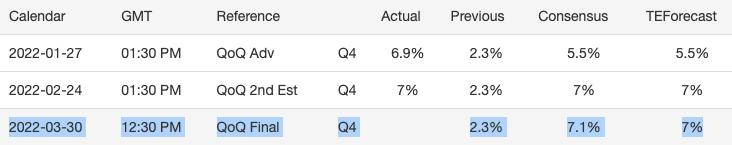

Economists anxiously await the Final GDP numbers for 2021

Key Earnings Announcements:

A relatively calm week of earnings before April & May quickly brings back the chaos.

Monday (3/14): Nike, Tencent Music Entertainment Group

Tuesday (3/15): Adobe, BuzzFeed, Carnival

Wednesday (3/16): Cintas, Clear, Colgate-Palmolive, General Mills, KB Home, Tencent Holdings

Thursday (3/17): Darden Restaurants, FactSet, Nio

Friday (3/18): Privia Health

Where we’re looking:

Adobe (ADBE) — During last week’s Adobe Summit (described here), the company made it clear that they are building out their Creative Cloud for both individuals and enterprise. I’m excited to hear what the current financials are looking like, and I imagine we’ll hear more about how they’re trying to differentiate themselves in the Digital Experience space. I’m also keen to learning more about the company’s progress with Workfront — this was a $1.5B acquisition that took place in late-2020.

Nike (NKE) — Analysts are TORN over how much supply chain, inflation, and labor issues are priced into Nike’s stock. Investors also worry that more brands are gaining ‘athleisure’ market share, which could negatively impact Nike in the long-run. Hell — even L.L. Bean just reported an annual revenue increase of +14% that was boosted by exponential sales growth for active apparel, active footwear, and winter sports. To put that in perspective, Nike is expected to report mid-single digit growth.

Clear (YOU) — With travel picking back up in a major way, I’m excited to see how the market reacts to Clear Secure — which is essentially TSA Pre-Check on steroids. I currently have 0.7% of my portfolio invested in YOU.

Investor Events:

All eyes on Nvidia’s GTC 2022.

Monday (3/21): Adidas Innovation Day in Germany

Tuesday (3/22): Lululemon Enters Footwear Industry, RealReal Investor Day, Vail Resorts Invest Day

Wednesday (3/23): Petco Investor Day

Monday (3/21)-Thursday (3/24): Nvidia GPU Technology Conference (GTC) 2022

Nvidia’s annual conference is among the most respected in the broader markets.

Topics include:

Accelerated Computing & Dev Tools

Artificial Intelligence

Autonomous Vehicles

Computer Vision / Video Analytics

Cybersecurity

Game Development

Robotics

We’ll make sure to sum-up the highlights in the upcoming Week in Review!

Nvidia now trades more than -20% off their recent all-time-highs. We’re confident in the company’s ability to produce $100B / year in revenue by the turn of the decade, but their current value of 18X forward revenue is still on the frothy side.

Major Economic Updates:

We catch our breath this week on US economic updates & look forward to next week’s Final 2021 GDP reading.

Wednesday (3/23): New Home Sales

Thursday (3/24): Joblessness Updates

Friday (3/25): University of Michigan Sentiment Index, 5-Year Inflation Expectations

Given this slower week, experts are already looking to the Final GDP stats that come out next week.

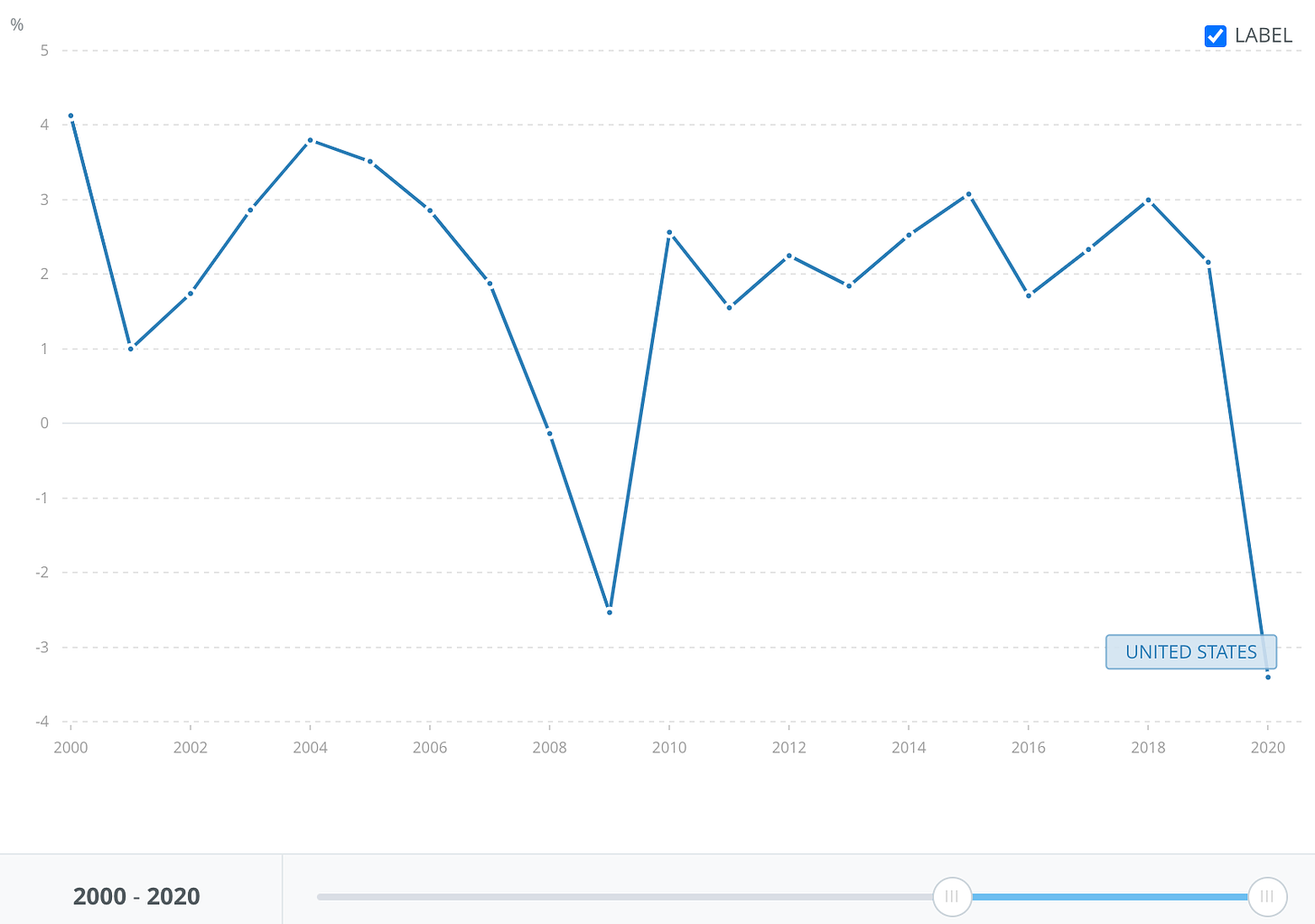

The best way to describe our economic situation is awkward.

In some ways, our economy is strong and recovering from being shut down for months on end. In other ways, we see our geopolitical strength faltering, with China growing in strength. While Gross Domestic Product isn’t necessarily a zero-sum game, the positioning of the US on the global stage could greatly impact these readings for years to come.

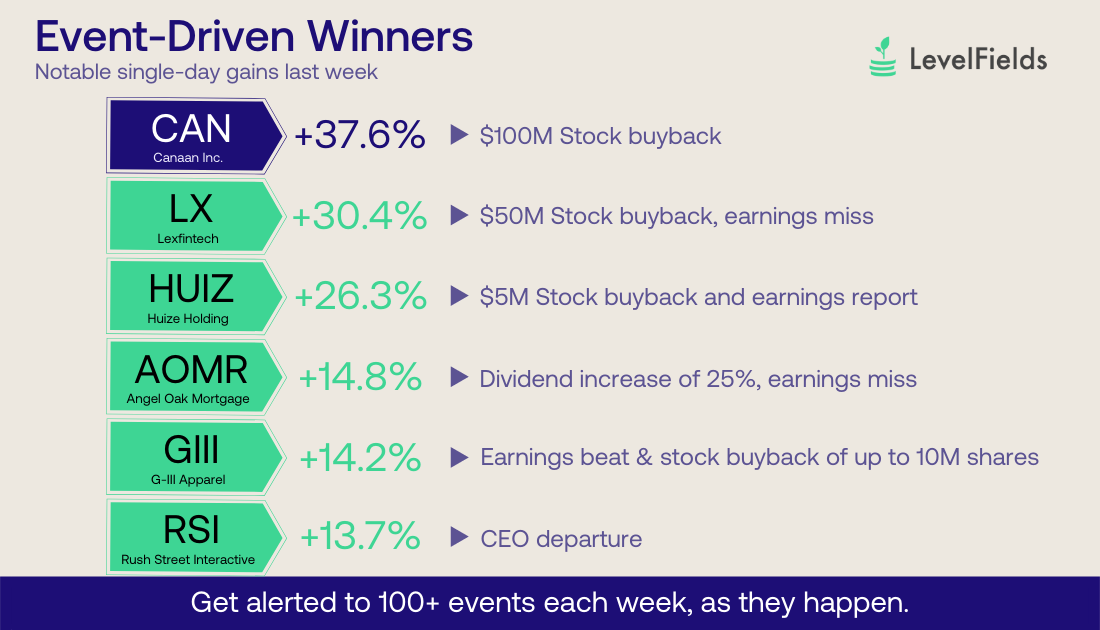

Events-Driven Winners:

What specific events are moving stocks the most?

Our friends at LevelFields took the time to scrub through thousands of data points and determine how events impacted stock prices last week. It’s a great platform for catching trading opportunities as they arise.

If you find these Week Ahead posts helpful, please consider sharing with a friend! Have a great start to your week!

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.