The week ahead 03/14/2022

Happy Monday!

If you’re feeling productive, consider reading this detailed breakdown of 7 different ways to generate passive income — getting you one step closer to retirement.

No time? Here are the highlights:

-

Dividend stocks

-

REITs

-

Traditional Real Estate (Fundrise)

-

Traditional Real Estate (Burrowvest)

-

Traditional Real Estate (Buy & Rent)

-

Vending Machines

-

ATM Machines

In this post, we’ll cover:

-

Quarterly financial reports worth reading

-

Investor events to keep an eye on

-

Major economic releases

-

Event-driven winners

Consider using Seeking Alpha to conduct your research along the way.

The Investing Week Ahead – Too Long, Didn’t Read:

Companies like GitLab, Williams Sonoma, Dollar General, FedEx and GameStop are reporting earnings this week. Adobe is hosting a summit with speakers including the CEOs of Nike and Walgreens. Starbucks is hosting their annual meeting — just in time for my deep-dive analysis on Dutch Bros (BROS) to be released. March Madness is upon us, so keep an eye out for OSB companies like DraftKings and BetMGM. Wall Street is predicting 6 to 7 rate hikes this year to combat inflation.

Key Earnings Announcements:

A few familiar faces near the back-half of the week.

Monday (3/14): Coupa Software, GitLab

Tuesday (3/15): Dole, Shift Technologies, Sentinel One

Wednesday (3/16): Pager Duty, Williams Sonoma

Thursday (3/17): Accenture, Dollar General, FedEx, GameStop, Xometry, Warby Parker

Friday (3/18): On Holding AG

Where we’re looking:

Gitlab (GTLB) — has been a “short” idea for a few weeks now, originally shared here. Their stock is down -45%, so those of you who bought put options should be up +150-300% in ~3 weeks time. Mind you — they’re still trading for 25X forward revenue. Congrats to any of you that bought puts!

Sentinel One (S) — I’ve wanted to do a deep dive on for months now. Hopefully the company will release an annual report with plenty of detailed information allowing me compose one.

Accenture (ACN) — crushed their last earnings, and I expect the same this go around. I’m really not sure what FedEx is going to say about rising gas prices, but I’ll be listening for this commentary so I can try and apply it to Amazon’s logistics cost.

On Holding AG (ONON) — the Swiss-based athleisure brand, backed by tennis legend Roger Federer. I have no position, but am interested to see their latest earnings as they have some of the most popular sneakers on the market.

Investor Events:

Adobe and JP Morgan host marquee conferences, Starbucks hopes to keep investors happy after being down -32% YTD, & March Madness has arrived.

-

Tuesday (3/15): Adobe’s 3-Day Summit Begins, JPM Industrials’ 3-Day Conference Begins

-

Wednesday (3/16): Starbucks Annual Meeting

-

All Week: Sports betting operators look to rake in huge amounts of revenue with the start of March Madness. Let’s keep an eye on BetMGM (MGM), Caesars Sportsbook (CZR), and DraftKings (DKNG)

Featured speakers of the Adobe Summit include Adobe’s CEO, Nike’s CEO, StockX’s CMO, BMW’s Sr. VP of Customer & Brand, Walgreens CEO, Olympian Allyson Felix, Actress Kristen Bell, and Actor Ryan Reynolds.

…I have no idea why Ryan Reynolds will be a featured speaker, but it’s pretty awesome.

Major Economic Updates:

The March FOMC Meeting has our full attention.

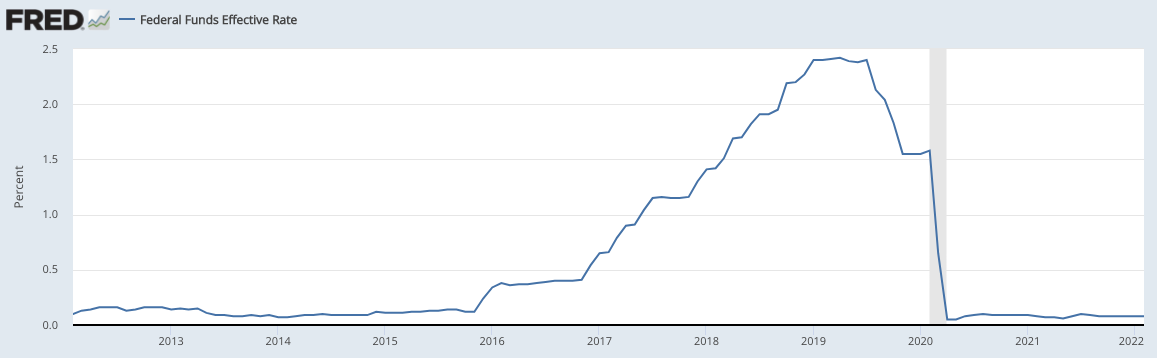

Beginning tomorrow (3/15), the Federal Reserve’s policy-making committee will hold its next meeting — with a 25 basis-point rate increase widely expected. Jerome Powell essentially guaranteed it during his last Congressional testimony, so it’d be pretty bizarre to see anything other than that take place.

UBS: “We think the median projection for 2022 will be revised from three hikes in December, to six or seven in March. By the end of 2024 we expect the median assumption for the federal funds rate will be around 3.0% to reflect a ‘whatever it takes attitude’ in taking inflation down.”

JPMorgan: “We now look for the Fed to hike +25bp at each of the next nine meetings, with the policy rate approaching a neutral stance by early next year.”

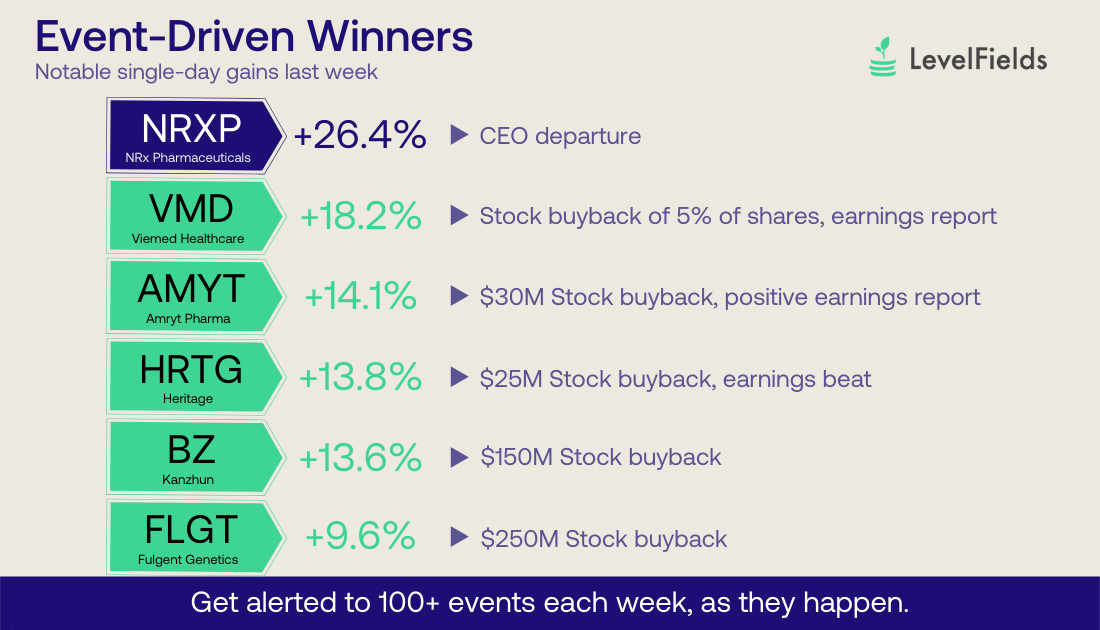

Events-Driven Winners:

What specific events are moving stocks the most?

Our friends at LevelFields took the time to scrub through thousands of data points and determine how events impacted stock prices last week. It’s a killer platform for catching trading opportunities as they arise.

I mentioned LevelFields in this video — explaining Amazon’s stock split. I love using the platform to find what makes stocks move (particularly during bear markets). We were not paid to promote their product, and simply think you’d find it to be a very valuable platform!

If you find these Week Ahead posts helpful, please consider sharing with a friend! Have a great start to your week!

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.