Deep Dive: Cheap Real Estate Investing

Diversification is Key… for Who?

One of my favorite stats is the one about how the average millionaire has seven streams of income. Generally speaking they look something like this:

-

Dividend income from stocks owned

-

Earned income from W-2 jobs

-

Rental income from real estate

-

Royalties from selling rights to use something they produced or invented

-

Capital gains from selling appreciated assets

-

Profits from businesses they own

-

Interest from savings, CDs, bonds, or other lending activities

However, I think it’s important to responsibly back into this notion of “several” income streams… Is this how folks build their wealth, too?

I’d argue no.

In my experience, and in the case of many others, the largest chunk of an individual’s wealth didn’t come from making a little bit of money from several different sources. Instead, it came from making overly-risky, calculated bets on something they knew a lot about.

For example, I have a friend who became a millionaire in his late-30s by making a massive bet on Tesla in 2012. He told me he even (irresponsibly) borrowed against his house to invest as much money as possible into the company. He spent quite literally thousands of hours on EV-focused online forums learning as much as he possibly could about Tesla and their future.

He had extremely high conviction and it worked out for him.

Calculated, focused bets with asymmetric risk / reward ratios are the way many millionaires have made their money. This bet could come in many shapes and sizes — in the form of a stock, the growth of a business, or maybe even a cryptocurrency.

However, people preserve their wealth by having it diversified across several investments — alluding to the seven streams of income for the millionaires mentioned above.

One of my favorite quotes comes from Cornelius Vanderbilt, and I think it’s very relevant to this post. It goes something like this.. “Any fool can make a fortune; it takes a person of brains to hold on to it after it’s made.”

I absolutely believe that the average millionaire has seven streams of income. They’ve made their massive bets and they’ve paid off. Now they want to work toward preserving their money.

However, I’m sure there are a lot of people reading this, myself included, who aren’t exactly where they want to be from a net worth perspective. They’re still looking to make those big, calculated bets. In this post, I wanted to spend some time exploring just how calculated or big investing in real estate through Fundrise might be.

Heightened Inflation —

Over the last few months, I’ve spent a lot of time thinking through “building wealth” during years of high inflation.

In case you didn’t know, heightened inflation usually means one thing — higher interest rates. The Fed told us just this week that they’re going to raise rates again by +0.5% in May. This is the first time since 2006 the Fed increased rates at back-to-back meetings; and a +0.5% bump would be the first time since 2000.

Generally speaking, the Fed raises interest rates to stifle the economy — which isn’t exactly good for the stock market.

Considering the most tried and true way to build wealth is by investing in the stock market, you now see my dilemma. I want to grow my wealth, but without putting all of my eggs in one basket (the stock market).

As I approached thinking through this, the first thing I did was try and find another time in history when inflation was running as hot as it is today.

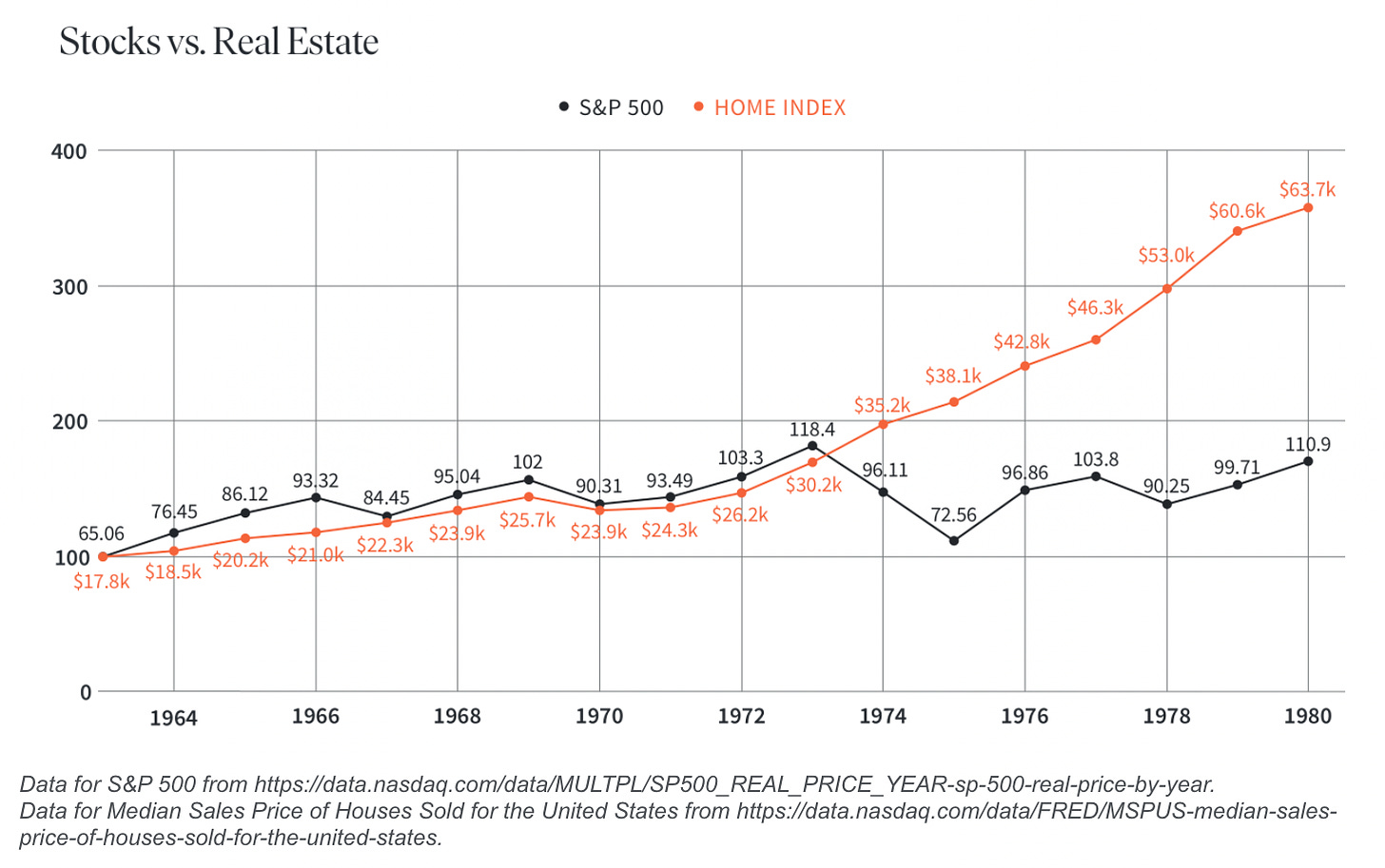

Throughout the 1970s, we had a similar inflation profile.

The “easy money” directive of the central bank, the abandonment of gold, and Keynesian economic policies all contributed to high inflation in the 1970s. Today’s inflation is a different story, but a story of “high inflation” nonetheless. Excessive money printing, tight supply chains, and healthy labor markets all contributed to the price rises we’re currently combatting.

Despite not being alive during the 1970s, data exists that points us toward an investment with solid potential risk-adjusted returns.

The median sales price of homes sold throughout the year of 1970 was ~$24K.

Interest rates in 1970 were 20% at this time, pricing a lot of people out of new cars and homes. Over the coming 10 years, the median sales price of homes nearly tripled to $64K.

The stock market? The same can’t be said.

Over the same 10 year period, the stock market traded up only +20% — after adjusting for inflation, this +20% gain turned into a -40% loss.

If you haven’t already, I highly encourage you to read the post below. It’s my argument for why I believe the stock market likely has more downside ahead:

So if stocks are falling, our money is worth less and less, and there’s no end in sight — how can we build wealth?

Where do we make these big, calculated bets?

Personally, I think the answer here lies upon one major piece of data.

America is short more than 5 million homes, and builders haven’t been able to make up the difference.

We’re operating in this “perfect storm” for real estate where tens of millions of millennials are finally ready to buy their first home, interest rates are still relatively low, and people are continually migrating toward the Sun Belt given work location flexibility.

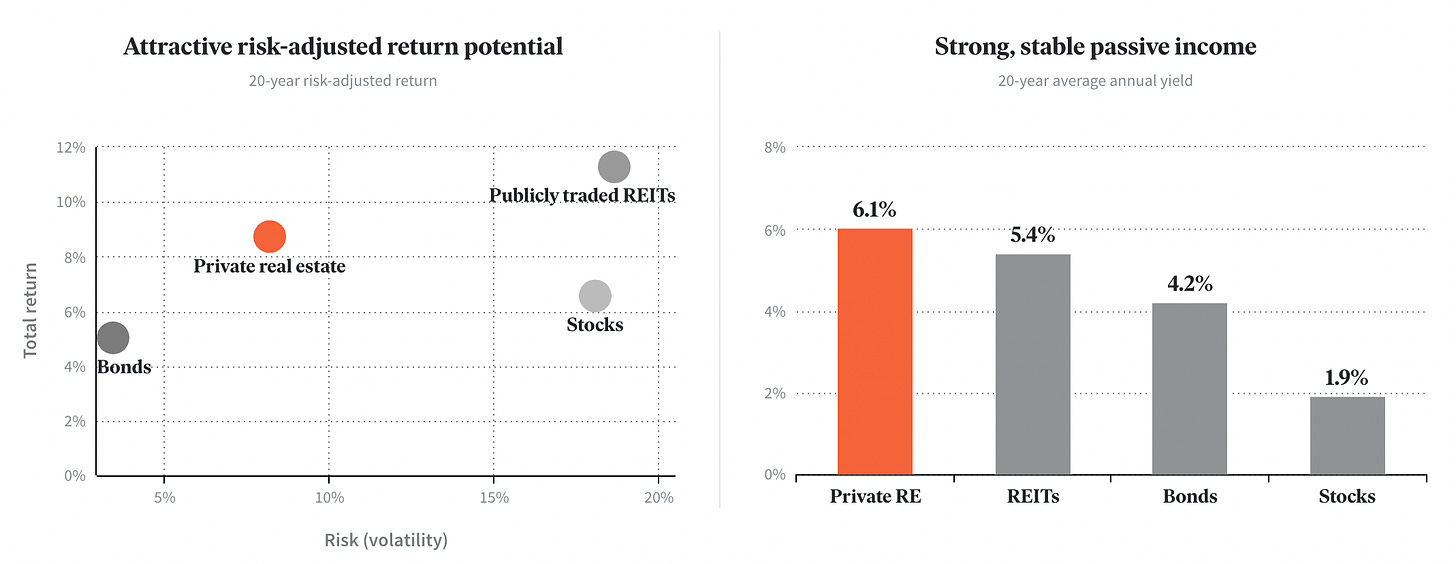

Here’s how I see this playing out — the Fed will continue to rock the markets in efforts to tighten them, of course including raising interest rates. There will be a bump in the unemployment rate, and there will likely be a marginal decrease in home buying. However, from a risk-adjusted returns perspective I believe the (supply-stricken) housing market will outperform the (high-flying) stock market over the coming years.

Strategies —

Feel free to follow along here.

In case you aren’t familiar, Fundrise is an online platform that allows anyone to invest in real estate historically only offered to institutions (like the ones mentioned in this post).

Used by over 260,000 investors, including myself, Fundrise pools together your money with thousands of other people’s to buy real estate. These properties come in all shapes and sizes — apartment complexes, commercial warehouses, rental homes, and even completely new developments.

Similar to Betterment (the world’s largest robo-advisor) — Fundrise is a “robo-advisor” that specializes in real estate deals. You deposit money (knowing it’ll take several years to see a return), and let them go to work!

The company deploys this money in four different approaches:

-

Fixed Income

-

Core Plus

-

Value Add

-

Opportunistic

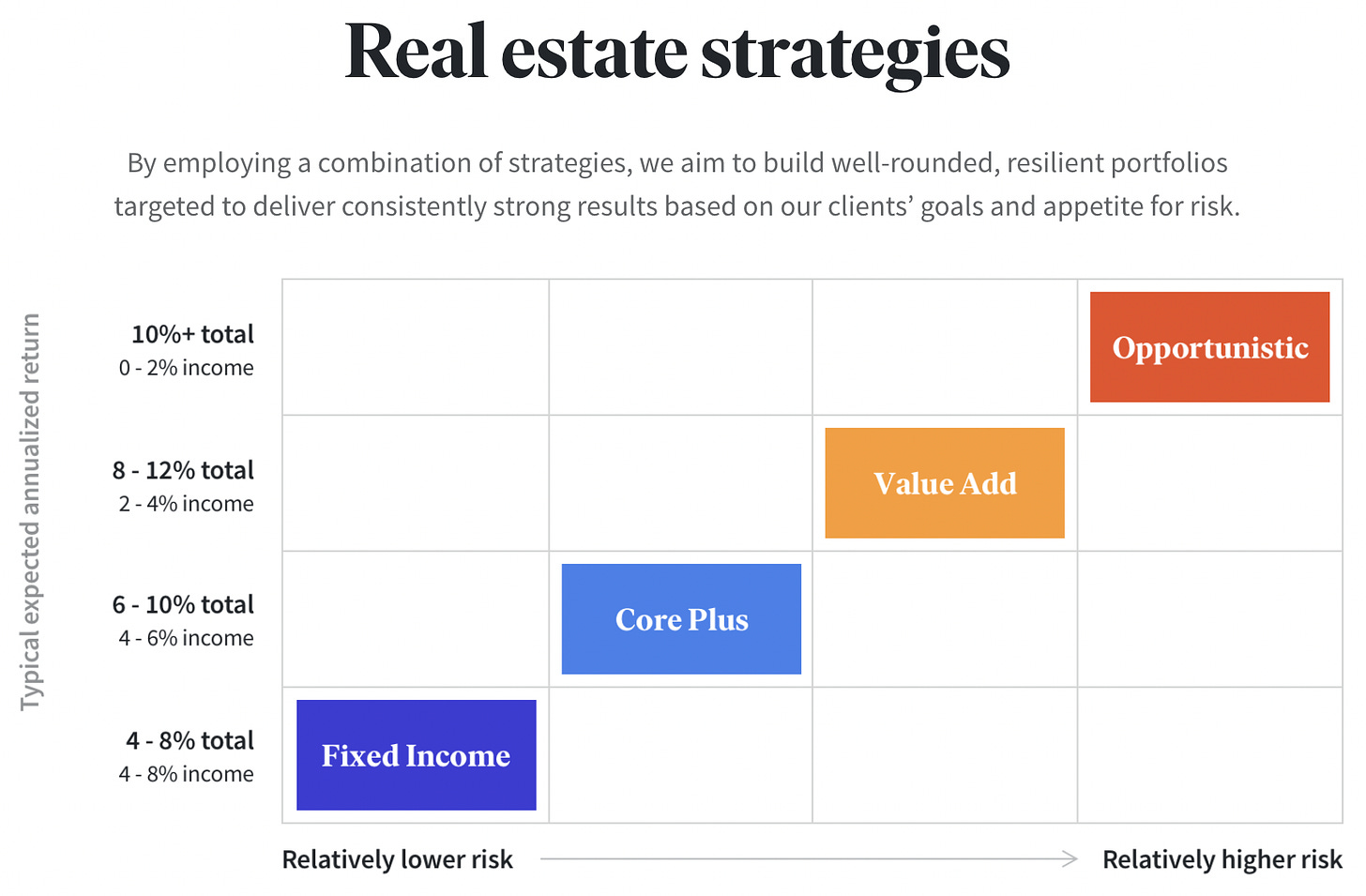

As you can tell by the colorful chart above, each strategy has a different risk / return profile — with Fixed Income having the lowest risk (with the lowest reward) and Opportunistic having the highest risk (with the highest reward).

As we lean back into the notion of “big, calculated bets” to drive wealth generation over the coming years, Opportunistic seems to be that. However, for the sake of understanding I’m going to dive deeper into each strategy mentioned above.

Fixed Income

Our Fixed Income strategy seeks to generate above-market yields by providing creative and comprehensive financing solutions underpinned by high-quality real estate. We seek to lend with a margin of safety to product types with high durability of demand (e.g., housing) and real constraints on new supply, thereby supporting property values.

Think of this as the low risk / low return side of the aisle. There are plenty of people out there looking for consistent and predictable income — if they’re in retirement, coasting, or just want the “rental” income.

Fundrise’s Fixed Income strategy offers just that.

By investing into apartment complexes (safe, predictable income) Fundrise is able to pass their rents on to you.

Annual Return Expectation: +6-8% in cash dividends

Core Plus

Our Core Plus strategy features stabilized real estate with a long investment horizon and moderate leverage, where we can unlock additional value through focused asset management. We aim to buy quality assets at an attractive basis in growing markets across residential and industrial asset classes.

Generally speaking, this is what people think of when someone says “real estate investing.” Rental houses and new apartment complexes. These are those investment opportunities everyone is trying to get in on, but only the ones with established networks can truly obtain.

By investing into budding apartments and rental home developments, Fundrise is able to see the best of both worlds — predictable income and moderate price appreciation over the long term.

Annual Return Expectation: +8-10%, with +4-6% in cash dividends

Value Add

Our Value-Add strategy focuses primarily on acquiring existing properties below replacement cost and investing capital to increase their competitiveness. We focus primarily on acquiring reasonably-priced residential communities in growing markets where affordable rental housing is scarce.

You remember those old shows on HGTV where people would buy 20-30 year old homes, renovate them, then resell them within about a year? That’s this. Fundrise identifies old warehouses, apartment complexes, and other properties with future potential — but are a bit rough around the edges in their current state.

For example, Fundrise spent a few million purchasing an old commercial building a few years back in Los Angeles, smoothed off those rough edges, and now it’s a creative studio.

If done correctly, this strategy can be incredibly lucrative. Identify solid properties in healthy areas, give them the tender loving care they deserve, then sell them. However, these projects tend to take time and typically don’t begin to cash flow or see any return on investment for 12-18 months while under construction.

Because of this, they’re categorized as a bit more risky — considering people can’t exactly predict the impact the moving markets will have on the end result’s value.

Annual Return Expectation: +10-12%, with 2-4% in cash dividends

Opportunistic

Our opportunistic strategy seeks to acquire underutilized, well-located properties in the most dynamic markets. With the combined expertise of our in-house development team and best-in-class partners, we reimagine these properties, often from the ground up. These business plans are the most complex and longest-dated that we execute, but carry the potential for the greatest reward.

Gotta risk it to get the biscuit, right?

If Fixed Income is on one side of the aisle (predictable, low risk), then Opportunistic is on the complete opposite side of the aisle (no certainty, high risk).

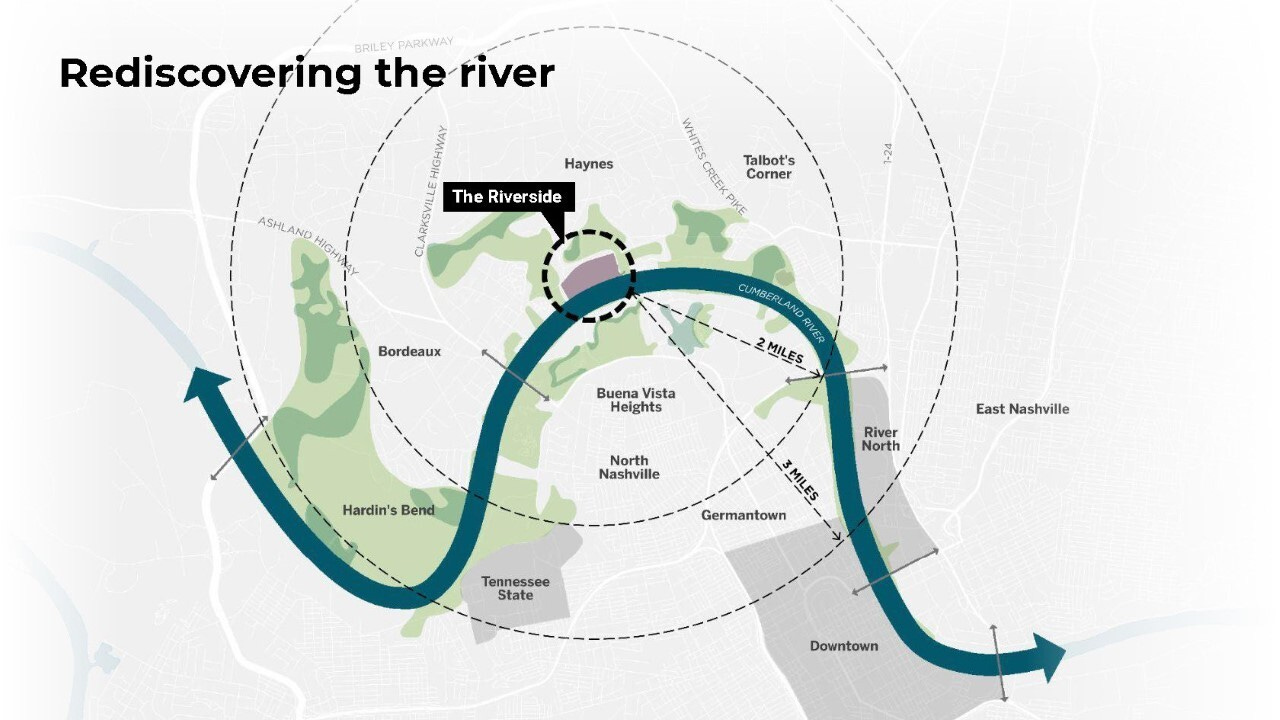

An example of this is sort of like what’s being developed in North Nashville right now from scratch — some Texas real estate tycoon is investing $2.5 billion toward developing 65-acres of wooded forest just 3 miles north of Downtown Nashville.

This is $2.5 billion tied up in labor, materials, and capital — waiting to be developed into a thriving, cash flowing community.

Will the Nashville market remain hot? Will the North Nashville market experience similar demand as Downtown? Will there be legislation passed to ban more Airbnb rentals?

Who knows!

This is why it’s an Opportunistic idea. Fundrise is presented with similar opportunities to jump at — and they take them. These are those big, calculated bets that deliver more outsized returns.

Annual Return Expectation: +12-15% with no cash dividends

I wanted to round off this section of my post with actual returns Fundrise has delivered for their investors over the years.

In 2021, Fundrise delivered..

-

~18% returns for the income-focused investors

-

~23% returns for their balanced investors

-

~25% returns for their growth-focused investors

Their Flagship Interval Fund returned ~40% to their investors, however, from a time-weighted perspective this number drops to “only” ~28%.

Now I’m not at all saying Fundrise will be able to deliver similar returns in 2022 and beyond. However — history tells us tangible, real assets (like real estate) tend to be much more resilient during economic downturns. I’m optimistic.

In Q1, their Flagship Interval Fund returned ~5%, a great start to the year!

Are These Bets Big Enough?

Yes and no.

Yes, in the sense that 4-5 years of a strong real estate market can really move your portfolio in the right direction if aggressively investing toward it.

No, in the sense that Fundrise will never deliver “Tesla-like” returns.

However, with so much uncertainty (geopolitical, stock market, macroeconomic, etc.) around us — investing in real assets providing real utility is a generally a great idea. As I personally think toward my “investing” future, I’m planning for real estate (both tangible and through Fundrise) to remain a large part of that.

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.