China, COVID-19 & the “Mother of All” Supply Chain Shocks

Let’s face it — we are numb to news updates about the supply chain crisis. We’ve all accepted that it’s a lingering issue, but we’ll figure it out like we always do… right?

Recent developments out of China show that we may be in for more pain than we anticipated. In this post, we’re going to show you why many are calling for the “mother of all” supply chain crises.

Estimated Read Time: 8 minutes

(TL;DR) Too Long; Didn’t Read

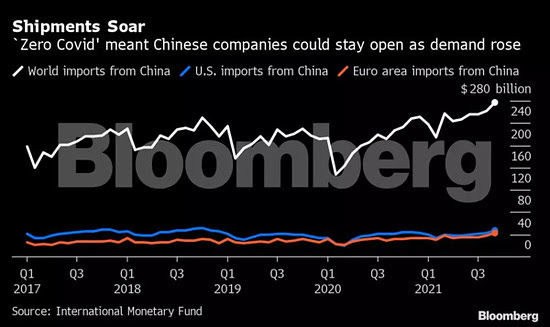

For years now, China has been incredibly strict with how they handle Covid — they actually have a “Zero Covid” policy. This “do whatever it takes” mentality has allowed them to stay firing on all cylinders as the world’s largest exporter — loading and unloading shipping containers 2-3X faster than anywhere in the world.

As the world’s biggest trading nation, its ability to keep factories humming through the pandemic has been crucial for global supply chains.

However, Omicron is more easily transmitted. Now imagine what happens if Omicron rampages through China, putting millions more people on a strict lockdown. It sounds like the backbone of our global supply chain could come to a screeching halt — causing a global economic slowdown.

Setting the Stage

To understand why some economists are so worried about this potential supply chain shock, you have to understand the main catalysts driving it.

1. China has a “Zero Covid” policy, with millions of people working diligently toward this goal.

Here’s a recent publication detailing how this policy is enforced at scale throughout China. A few examples of how extreme people take this policy include:

-

Hospital employees refusing admission to a man suffering from chest pains due to his residence being in a “medium-risk” district. He died of a heart attack.

-

Other employees refusing to admit an eight-months pregnant woman with bleeding issues due to an “invalid” Covid test. She lost her baby.

-

Community “Covid Volunteers” (described as an “Army”) forced a young man to read a self-criticism letter in front of a video camera. His crime? Going to get food because he didn’t have anything to eat.

At the time of reporting, the city of Xi’an (where the events above took place) had only 3 registered Covid-related deaths since early-2020. An astonishing 95% of their adult residents were vaccinated as soon as July 2021.

Despite all of this, harsh lockdowns were still put in place to eliminate the spread. More than 45,000 people were moved to quarantine facilities and residents weren’t allowed to leave their homes.

While only a few cities have gone on full lockdown recently, it’s important to consider how quickly things can be shut down.

China’s “Zero Covid” policy is taken very seriously — at all costs.

—

2. Chinese New Year is quickly approaching — February 1st.

The holiday traveling season began on Monday in China. Several Chinese cities have gone on Covid “high alert” — requiring travelers to report trips to their communities, employers, or hotels. People want to know who has been where.

Dozens of international flights to China have been canceled (scared of more Covid-positive folks flying into their country) and domestic flights are seeing mass cancellations as well.

Another example of “we don’t want to let anyone in, out, or around if they’re Covid-positive of any kind.”

—

3. The Winter Olympics will take place in Beijing from February 4-20.

Nearly 3,000 athletes will compete in 15 disciplines across 109 events. China wants to show the world that they are #1 and having any sort of issues with these games — televised to the world — is the Chinese leadership’s worst nightmare.

How do you mitigate that risk?

Locking people down and halting movement.

The Problem — Chinese Shipping Affects Everyone

China is the world’s biggest trading nation and its ability to keep factories humming throughout the pandemic has been crucial for global supply chains.

As you can see above, China experienced a massive drop in world exports during the Q1’20 timeframe (about -35% overnight). However, as the title indicates, the country’s “Zero Covid” policy meant Chinese companies could stay open as demand rose.

In case you forgot, countless American companies had to shut their doors during the pandemic — including critical manufacturers and factories nationwide. This “re-opening” is something we’re still dealing with today.

Due to China’s strict Covid diligence, they were able to mitigate its spread by taking extreme measures — allowing exports to bounce back quickly. Then when we had the Delta variant, China saw a hiccup — but then back to work.

However, with recent Omicron spread data gathered from the US — China might not be able to “bounce back” so quickly. Given their policy, they could put hundreds of thousands or even millions of folks into strict lockdowns at the expense of their supply chain operations.

And even if they did bounce back quickly, the brief dip in productivity could be the “shock heard around the world.”

While the outbreak of omicron in China is small compared with its Western peers, authorities are taking no chances. In recent weeks scattered infections of both the delta and omicron variants have already triggered shutdowns to clothing factories and gas deliveries around one of China’s biggest seaports in Ningbo, disruptions at computer chip manufacturers in the locked-down city of Xi’an, and a second city-wide lockdown in Henan province Tuesday.

Edna Curren, Bloomberg

This isn’t just about the US — it’s about the entire world.

While the US is the world’s largest importer, it’s much more important to focus on China being the world’s largest exporter.

If China isn’t able to ship goods around the world in an effective manner, the world economy will suffer.

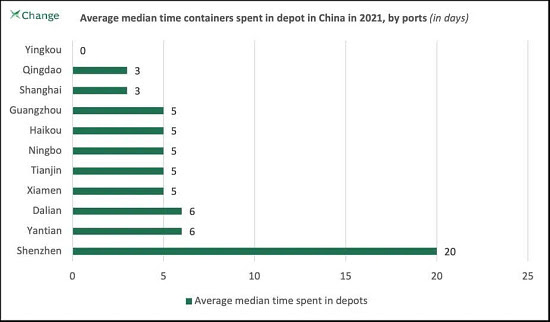

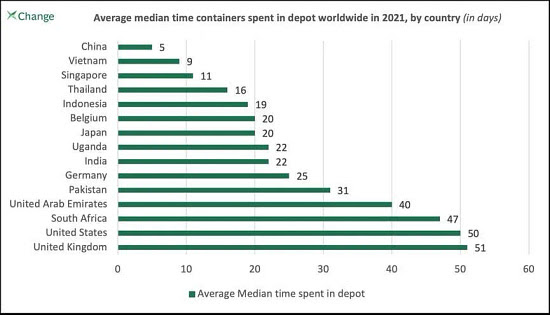

Take a look at the 2021 shipping data below… and try not to let your jaw hit the floor. The Chinese port with the worst average median time for idle containers was still over 2x quicker than the overall average of both the United Kingdom and the United States.

On average, shipping containers remained idle in UK and US ports 10x longer than in Chinese ports.

China is carrying the team right now.

Clearly, the Chinese know how to quickly address the issues and get things back up to speed. The danger? At some point, China could enforce their “Zero Covid” policies against so many people that there wouldn’t be enough left to keep their well-oiled machine humming.

No “well-oiled machine” equals essentially inevitable global disruption.

Has This “Mother of All” Supply Chain Shocks Begun?

Well, it’s hard to say.

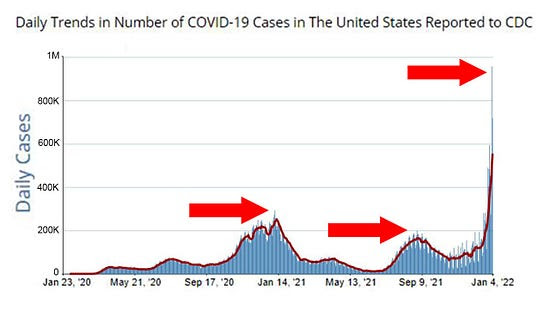

Below is a graph showing how quickly Omicron spread throughout the United States. Sure, we aren’t strict at all in relation to China — but still worth mentioning.

According to Deutsche Bank:

-

China’s first Omicron outbreak was detected in the city of Tianjin two weekends ago. On the morning of January 8, two patients were confirmed as being infected with the variant. After detecting the cases, massive lockdowns and screening took place — with 41 confirmed cases identified in the process.

-

According to local disease control officials, the source of the Tianjin cases are unknown and community transmission is possible.

-

More alarming, the same Omicron variant has already begun to spread outside of Tianjin.

In the Shannxi province, the total new cases have already exceeded 1,500 over the past two weeks — a record high. This is with a very high vaccination rate and strict regulatory lockdowns. As shown below, not only have we begun to see new cases trending higher this year — but the provinces being hit also have higher GDP and population density.

Deutsche Bank expects the Chinese government to contain the Omicron outbreak with more lockdowns and quarantines rather than a “live with Covid” approach — posing downside risk to near-term global economic growth.

The Result — Continued Price Increases Across the Board

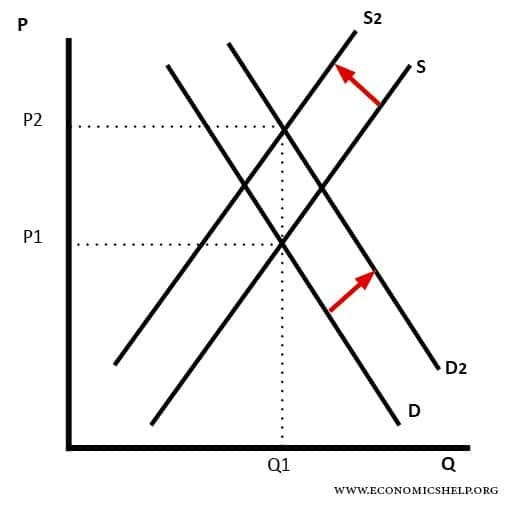

Whether you’re reading this 20 years out of schooling, or walking into Micro Econ 101 as you read this — let’s walk back to the all-important principle: Supply & Demand.

Let’s break this down — sustained demand for goods throughout the world paired with a limited supply (China isn’t shipping anything) equals price increases.

As a reference point, the chart above does a good job of depicting what’s been happening with pretty much everything that requires shipping. Demand has all-but slowed down, yet inefficient markets have caused supply to decrease. Brutal price increases are almost always the result.

What’s one of the most important things shipped around the world? Oil.

Oh and would you look at that! Goldman Sachs recently projected that oil prices will hit $100 by Q3 of 2022 and Reuters reported that oil prices have hit a 7-year high.

The Vanguard Energy ETF (VDE) has increased by +12% YTD, compared to the stock market’s -5% YTD.

This tells me that analysts have a firm belief that the demand for oil won’t necessarily go down, but the supply of it being shipped globally may suffer.

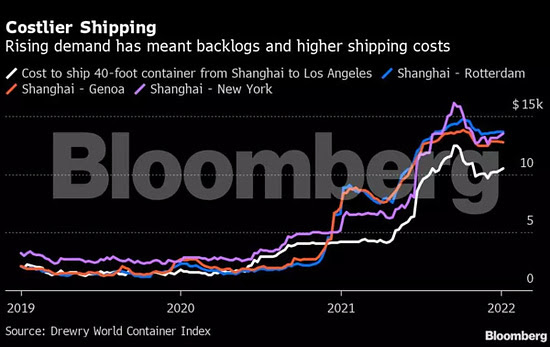

No, the chart below is not your favorite moonshot crypto coin. That’s the rising demand for shipping being paired with the increased costs to actually ship things to your front door.

From Shanghai to various locations around the world — it’s becoming more expensive. Imagine how much more expensive things become if China is shipping -30% less in 2 months? Sustained demand.. less supply.. higher prices.

By locking down and seeking “Zero Covid” cases — China has the ability to not only delay deliveries throughout the world, but also increase the cost of shipments overall.

Conclusion

I share these finding with you to help ensure that we’re prepared for what might happen.

If things truly get ugly, China’s recovery would likely be swift — as it has been in the past. However, the bull-whip effect the world (especially the US) would experience from another supply chain shutdown would be detrimental.

While the Fed is doing all they can to control inflation, the reality is that inflation experienced in the US cannot be solely healed through monetary policies. Supply chain constraints don’t care about your monetary policies.

Now we’ll see the Fed raise rates (hampering growth), just as we’re potentially heading into a worldwide drop in growth. If this “supply chain shock” comes to fruition, we’re likely back to quantitative easing again.

Long story short — make and follow a clear plan with your money, stay focused on a company’s free cash flow and not their stock price, and stick to a long-term investment horizon.

I’ll leave you with a quote from Benjamin Graham, the father of value investing and the author of “The Intelligent Investor.”

“The intelligent investor realizes that stocks become more risky, not less, as their prices rise — less risky, not more, as their prices fall.”

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.