The $2M Investment portfolio Revealed

I couldn’t be more excited to be writing this post!

After sharing the below post (Selling the Strength — 2023 Portfolio) a month ago, I’ve received a lot of questions, comments, and suggestions from you all. I’m incredibly grateful and I appreciate every single one of you who’ve reached out.

I’ve spent the last ~4 weeks or so carefully taking them all into consideration in anticipation for the post you’re reading right now. Let’s jump into things!

In this post I’m going to:

-

Share more tidbits about the stock market & economy

-

Link out my new portfolio tracker (subscribers only)

-

Explain how to invest alongside me (anyone and everyone)

I also know how much y’all enjoy charts and pictures — so I made sure to include a bunch of them in this post!

Macro Update — Stock Market & Economy

Unfortunately, we were correct.

As shared on December 3, 2021 — the market was indeed melting. It was time to rotate out of growth and speculation and back into large caps. Unfortunately, that “rotation” wasn’t enough.

On January 25, 2022 I shared my Bear Market Playbook — specifically calling out the strategy of investing toward companies who at the moment might be showing some short-term multiple compression, but over time we know will continue to outperform financially.

Below is an image I pulled from the post that further illustrates this idea.

Then on February 25, 2022 I shared Please be Patient — encouraging you all to not just “buy the dip” and then expect things to continue moving up and to the right. Below is an excerpt that summarizes things pretty well.

I’m on the sidelines. I’m not going to pretend like I have any idea exactly when this correction is going to finish. There hasn’t been a time in recent history when so many names within the S&P 500 are down -25% or more while the index itself is only down -10%.

In short, this correction looks incomplete to me in the longer-term.

Sure, we’ll see green days like we did on Thursday as markets bounce from being “technically oversold,” but I stand firm in my belief that we’ve entered a bear market that will likely last another 9-18 months.

And last another 9-18 months it has. We’re 10 more months into this and things are still looking grim. Let me explain.

2023 Recession Fears

Over the last couple of weeks it’s been made pretty clear that inflation is (thankfully) beginning to trend down, and that the Fed will eventually dial things down once we hit their ~5% terminal rate come June 2023.

Let me be clear — I’m not talking about rate cuts, I’m talking about less aggressive rate hikes. We saw the Fed raise interest rates by +25 bps in March then straight into four consecutive +75 bps hikes after that. They’ve recently dialed that back to a +50 bps hike, and will continue to slow things down into the second half of 2023.

With that being said, I continue to believe we’ll experience a recession in 2023.

We’ll get into why I believe this as well as what that might mean for the stock market — but all of that aside, as of today the stock market is not pricing in the possibility of a “hard landing” AKA a tough economic recession.

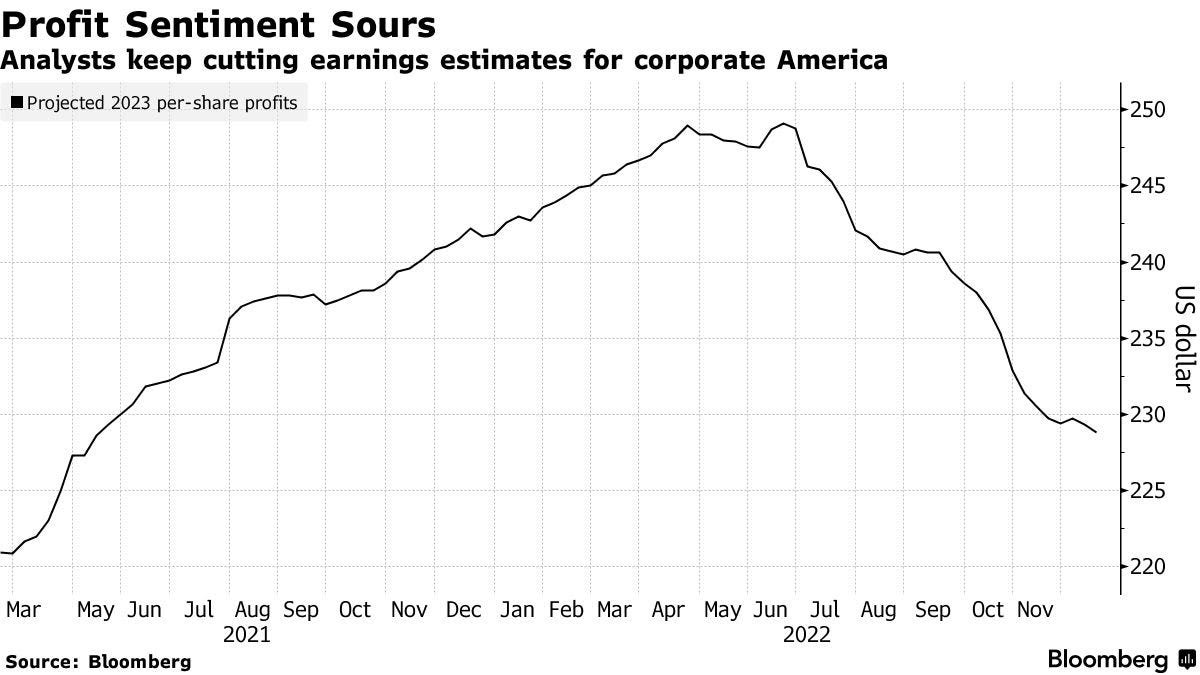

At ~16.5X forecasted earnings, the S&P 500 is currently valued at a multiple about one point above the 20-year average. Should earnings estimates fall (Wall Street is still expecting +4% earnings growth in 2023 for some reason) — this P/E ratio expands even further.

This begs the question.. why would stocks become more expensive if they’re producing less profits? Well, they shouldn’t. They should become less expensive.

Let’s assume we do experience a recession in 2023. Using data that dates back to World War 2, the shallowest earnings recession was -4.6% in 1980. This means during the “smallest” recession we’ve ever experienced — profits decreased only -4.6% YoY.

Now I don’t have a crystal ball, but I’m going to assume the Federal Reserve raising interest rates at the fastest pace in history doesn’t conclude with us experiencing anything similar to the “smallest” recession in history.

Above is a chart that illustrates past US recessions from peak to trough — specifically months of economic contraction, quarters of earnings (EPS) decline, and how earnings (EPS) changed. That last line item is the one I’m looking at — the one that shows an average earnings per share decline of -18.7%.

If we experience a recession in 2023, it will more than likely at least be average — which means earnings per share (EPS) will likely decline roughly -20%. Again, Wall Street is expecting EPS to rise +4% in 2023.

Why is Wall Street forecasting a +4% increase in earnings next year when Morgan Stanley and other LEIs (Leading Economic Indicators) are forecasting a recession?

Good question. Weirdly enough, right now we’re experiencing the largest “disagreement” in where earnings are headed in the next 12 months since August of 2008. Think about that for a moment — we haven’t seen such a divergence between what Wall Street Consensus is telling us and what the LEIs are forecasting since right before the market tumbled some -40% before finding a bottom.

Now let me be clear — I do not believe the market will tumble -40% in 2023. However, I do believe we’ll see a 3,000 — 3,300 S&P 500. This would imply an -18% selloff from current levels to the midpoint of my assumption.

But Austin, the job market is strong and things are looking decent — why the bearish sentiment? What’s making you think this?

Sure, the current job market is strong. However, the number of new job listings is declining — made clear by the Job Openings and Labor Turnover Survey. There were 10.3M vacancies for October, down by -760K from a year ago.

The same survey also shows a downtrend in the “quits” level, trending toward 4M compared to 4.5M just 9 months ago. This suggests people are less confident about their prospects of finding employment elsewhere.

Pair this data with a personal savings rate of only 2.3% (the lowest since 2005) and all-time-high credit card debt of $1.2T and things just don’t seem right.

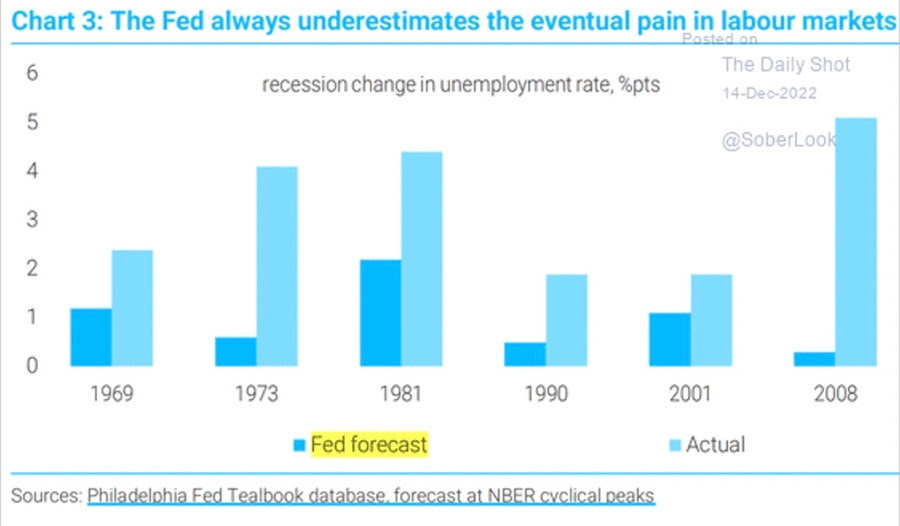

It’s also worth mentioning the Federal Reserve is assuming that the unemployment rate will increase to 4.6% by the end of 2024. Currently, unemployment is hovering around 3.7%. If we take a second to review how accurate (inaccurate) their forecasts have been in the past, we quickly come to the conclusion the unemployment rate might end up much higher.

The strength of both the economy and the labor markets have a direct impact on the price of stocks. For that reason, I believe in 2023 we’ll be presented with the opportunity to invest toward wonderful recession-lasting businesses at depressed valuations.

If you like what you’ve read so far feel free to share it with someone you think should know about 2023’s looming recession.

The $2M Dividend Growth Portfolio

No, it’s not worth $2M today — it’s worth only a few hundred dollars right now as I continue to test the rebalancing features within the platform I’m using to invest. But this is soon to change.

As you read from the post above, I’m building this from scratch starting in January. The goal is $2M by the end of the decade — and here’s the math on that.

Again, I want to begin a journey with all of you.

Sharing the ups, the downs, the reflections, and more importantly taking your feedback and ideas into consideration.

I want this journey to be something we can all do together.

Forget about the zeros behind these numbers for a moment — your journey might be to end up with $20,000 by the end of the decade. Maybe $200K, who knows? But something this community has been missing since its inception in 2020 is a collective journey toward a common goal.

I’m a firm believer in earning passive income and making my money work for me.

Qualified dividends paid to me on a regular basis certainly tick that box. With that being said, let’s explore the new portfolio tracker together.

LINK TO PORTFOLIO TRACKER ON GOOGLE SHEETS

The above link will only work for paying subscriber to Rate of Return ($13/mo) as I’ve already granted access to your email addresses.

The first thing you might all notice are the numerous tabs near the bottom — these tabs categorize all of the companies as I did originally in this post.

-

Dividend Growth

-

REITs

-

Special Circumstance

-

Long

Each of these tabs have the same headers — Ticker, Name, Portfolio Weighting, Avg. Cost per Share, Current Price, Profit / Loss (%), Wall Street’s Price Target, Up / Downside to WS Price Target, Forward Dividend Payment, Dividend Yield on Cost, and 5-Year Dividend CAGR.

You’ll notice the dividend yield on cost and 5-year dividend growth CAGR are much higher for the stocks in the Dividend Growth tab vs. Long or even REITs.

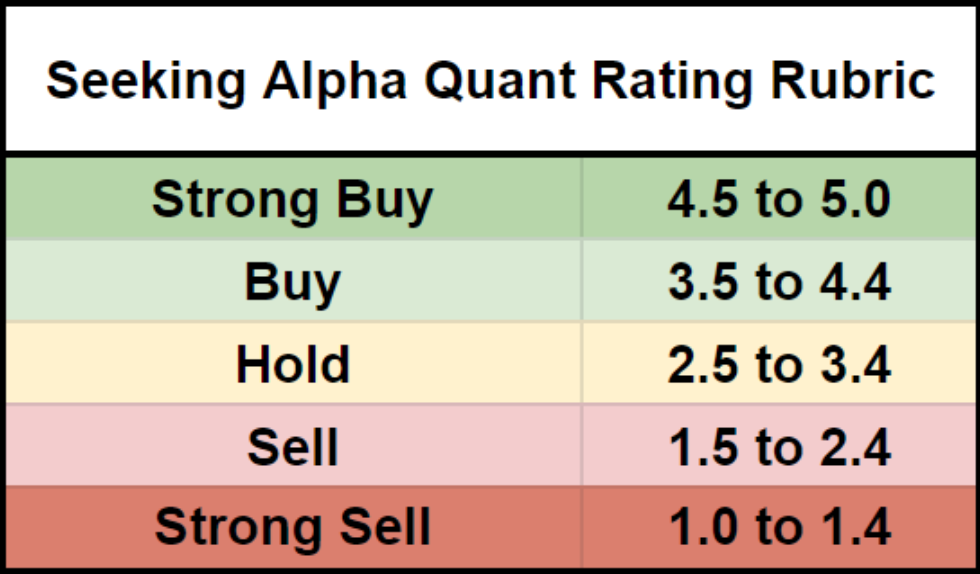

The next tab you might notice is the Research Library. This tab is sort of the “Home Base” that displays every single stock I currently own, a link to my most recent published research on the company, and even Seeking Alpha’s Quant Rating.

For those of you who might not be familiar, Seeking Alpha offers their Premium subscribers access to their Quant Rating system. Essentially it’s a mathematical formula that spits out a number (shown above) derived from things like employee headcount, profits, revenue growth, and other proprietary information.

For example, here’s a graph that shows the stock price of a company called Super Micro Computer (SMCI) and their historical Quant Rating on the company. There’s a clear correlation between when their rating system flipped “Strong Buy” and stock price appreciation.

I’m a Premium subscriber to their platform and am happy to share my portfolio’s Quant Ratings with you all.

There are currently four companies in my portfolio that have a “Strong Buy” from Seeking Alpha’s Quant Rating — you can see them labeled in the Research Library.

I intend to keep this updated on a weekly basis. And for those of you wondering, no, there aren’t any companies in the portfolio with a “Sell” or “Strong Sell” Rating.

My First Deployment of Capital

As I’ve explained in detail above, I believe the stock market is heading lower in 2023 as the economy continues to deteriorate. With that being said, I’m going to begin slowly dollar cost averaging into the positions shared in my portfolio tracker.

My first “push” toward the names listed in the Portfolio Tracker will be roughly $8,500 — I plan for this to be fully invested by the end of the year, starting January off with a bang. Keep an eye out for me sharing more details about when this money has cleared and been deployed — I’ll be sure to share screenshots and transaction history.

I’ll also be sure to notify you all when the data is properly reflected inside of the portfolio tracker.

How to Invest Alongside Me (Algorithmically)

I’m very excited about this!

As I had shared with you all in this post, Quantbase is making it incredibly easy for anyone and everyone to invest alongside me toward dividend growth stocks.

For those of you who might be unfamiliar, Quantbase was founded in 2021 by Som Mohapatra and Thomas Stewart to make aggressive, algorithmic investing accessible to everyone. Think “robo-advisor” but specifically for high-risk strategies and ideas.

Essentially, Quantbase was unlocking access to hedge fund-like strategies to the masses. For example, you all might remember the below post about their Crisis Fund — a way to maximize profits during market panics.

Som built this trading strategy from scratch by using the learnings of this study published by Verdad.

I was fascinated by the idea of building a rules-based strategy of my own — so I told them about my dividend growth portfolio and my desire to invest toward stocks with medium-yield that exhibit high-growth.

Introducing the Dividend Growth Strategy

This rules-based strategy selects stocks from the S&P 500 with at least a 3% dividend yield, then invests toward the top 20 who’ve demonstrated the most aggressive dividend growth rates over the last 3 years.

When back tested to 2012, this strategy produced on average a 4.36% annual dividend yield, and a +10.16% annual dividend growth rate. Assuming dividends reinvested, this strategy outperformed the S&P 500 by +137% during that same period of time (shown above).

The Fund’s Rules:

-

Only select stocks from the S&P 500

-

Buy a stock if it’s forward dividend yield is >3%

-

Buy a stock if it’s 3-year dividend compounded annual growth rate is >10%

-

Sell a stock if its forward dividend yield drops below OR if its annual dividend growth rate drops below 5%

-

Rebalance every 8 weeks

Isn’t that crazy? Algorithmically pick stocks from the S&P 500 that exhibit very specific characteristics and the result is more than twice the benchmark returns?

My goal is for us all to build wealth together, so I made sure this process was as easy as possible. Here’s how it works —

-

Create a Quantbase brokerage account

Head on over to my personal landing page and click “Get Started” near the top. You’ll be prompted to answer all of the normal brokerage account questions (address, SSN, DOB, occupation, etc.)

IMPORTANT: be sure to use the same email address as you’re using to subscribe to Rate of Return! By doing so, you’ll get complimentary access and this will be completely free.

-

Subscribe to the Dividend Growth Strategy

Head over to the Partnerships tab near the top, click on “Austin Hankwitz,” and make sure the toggle is turned ON.

Once this is toggled ON, click on the Funds tab near the top, scroll down some, and you should then be able to see the Dividend Growth Strategy fund. If not, refresh your page or scroll around a few more times. It sometimes takes a bit depending on your internet connection.

-

Enjoy the journey

More information about the strategy (risk score, max draw down, monthly volatility, etc.) will be displayed on the fund’s landing page once you’ve successfully created an account and subscribed to the fund.

Simply click “Invest” to get started. You’ll also notice right below “Fund Holdings” are dates — these are the last times the holdings inside of the fund have changed given the rules shared above.

Alongside the $8,500 I’m investing toward the single stocks shared in the portfolio tracker, I’m investing an additional $10,000 toward the Dividend Growth strategy. It’s set to clear and deploy by the end of the year. Screenshot shared above ^^

Collectively, I’m investing $18,500 toward this $2M Dividend Growth Portfolio by year end — and I couldn’t be more excited to bring you all along for the ride! Expect multiple portfolio updates per month going forward.

We’ve been sitting on the sidelines for the last 10+ months in anticipation for more downside. We saw that, and there’s certainly more to come. However, I’m excited to begin deploying capital during 1H23’s volatility — specifically into wonderful businesses at wonderful prices.

I know there’s going to be a ton of questions, portfolio access errors, and troubleshooting — so please feel free to comment on this post, reply to this email, or email me individually at austinhankwitz@gmail.com with your feedback!

I’m confident 2023 is going to be a wonder year full of curiosity, intention, analysis, and curve balls. Let’s get after it!

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.